International Fundraising: Marketing & Fundraising in the USA for owner-managers Part IV

DISCLAIMER

You will need to speak to US Securities counsel for a more detailed explanation as I don’t want anyone to misunderstand what we are discussing generally here. You have to consult a US Securities attorney to be able to work out how to promote your offering and find potential investors. Our aim is to discuss the differences that apply to non-US business owners compared to US business owners when raising capital in the USA.

In this article, we explore how to raise capital from the US and international investors from the point of view of a non-US person who is raising funds for a non-US or international project. The business, whether it is oil & gas, mining, or agricultural export is classified as international in nature if it is not based in the US.

Raising upfront funds for marketing via NFTs

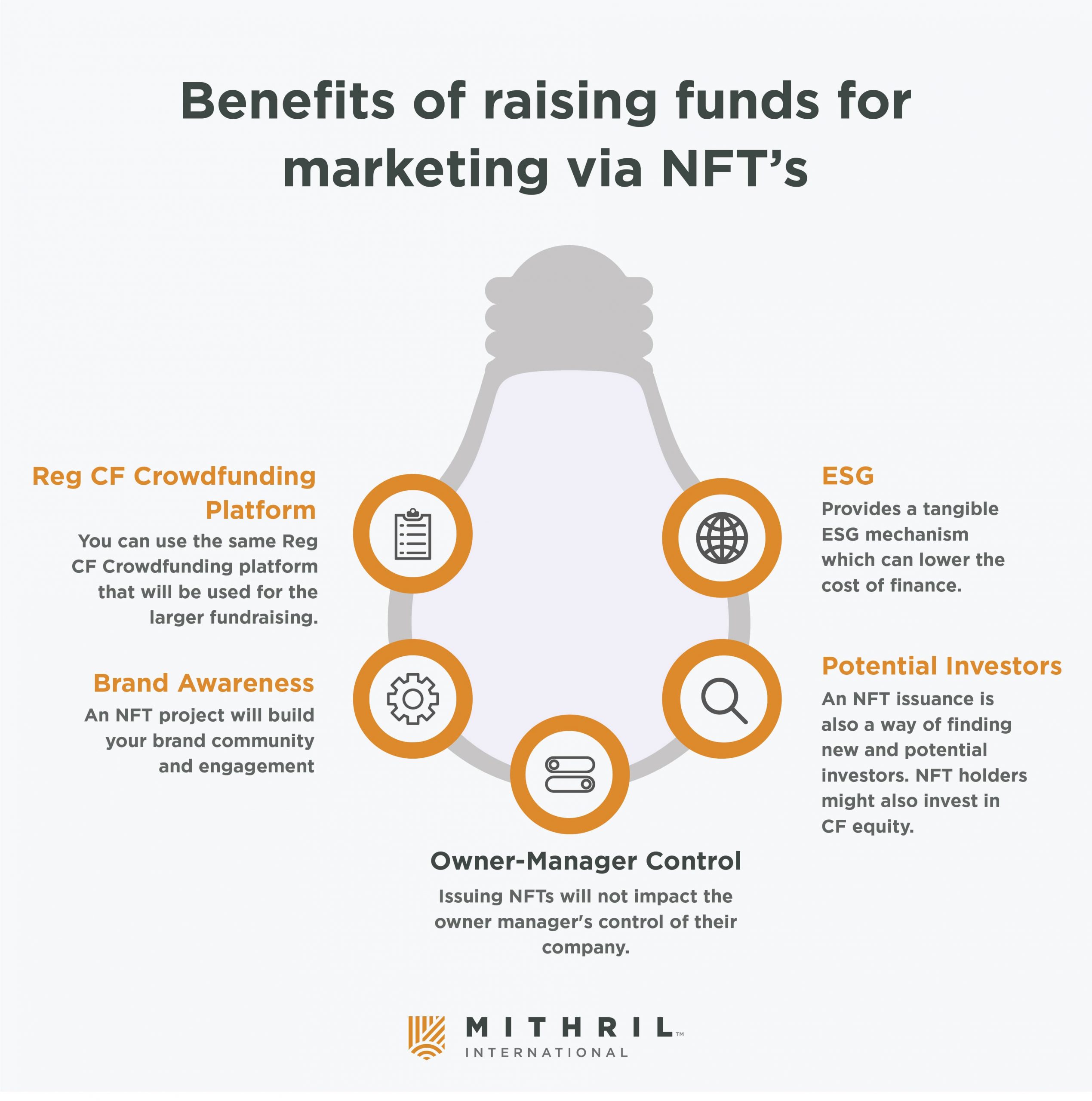

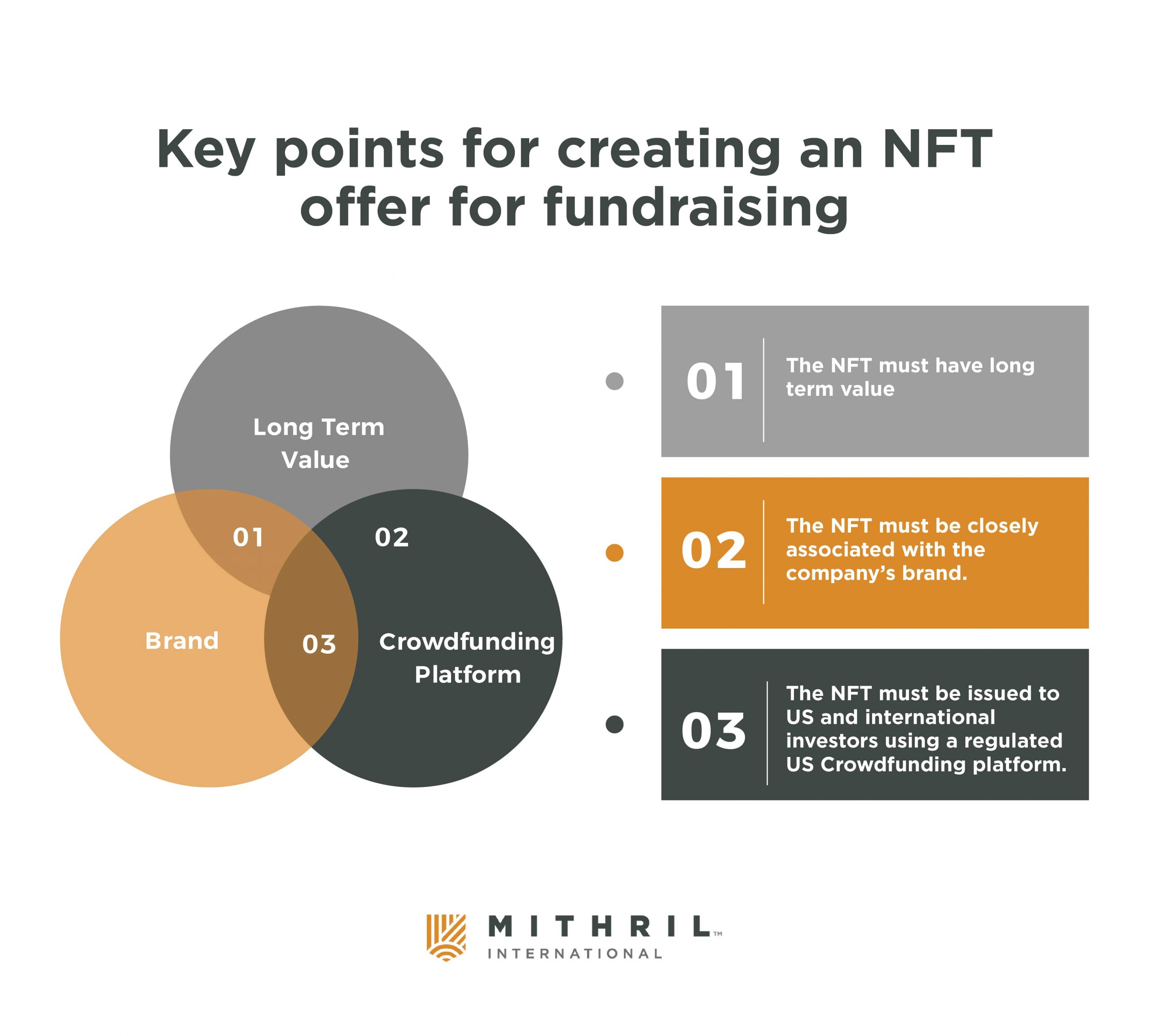

An NFT community engagement project where NFTs are issued to potential investors and maybe future investors is a possible way of raising funds for marketing in the US. NFTs should be assumed to be securities and can be issued the same way via Crowdfunding platforms. The NFTs must have long-term tangible value and be closely associated with the company’s brand. The use of NFTs could provide a range of benefits including;

- You can use the same Reg CF Crowdfunding platform that will be used for the larger fundraising.

- Community and brand engagement

- Non-voting and does not impact owner manager’s need for control

- Provides a tangible ESG mechanism that can lower the cost of finance.

- An NFT issuance is also a way of finding new and potential investors. NFT holders might also invest in CF equity.

The best aspects of NFTs should be utilized including a cost-effective blockchain, a verified rail or blockchain, and clear terms and conditions for the NFT being issued related to the offering documentation.

Using NFTs for international fundraising

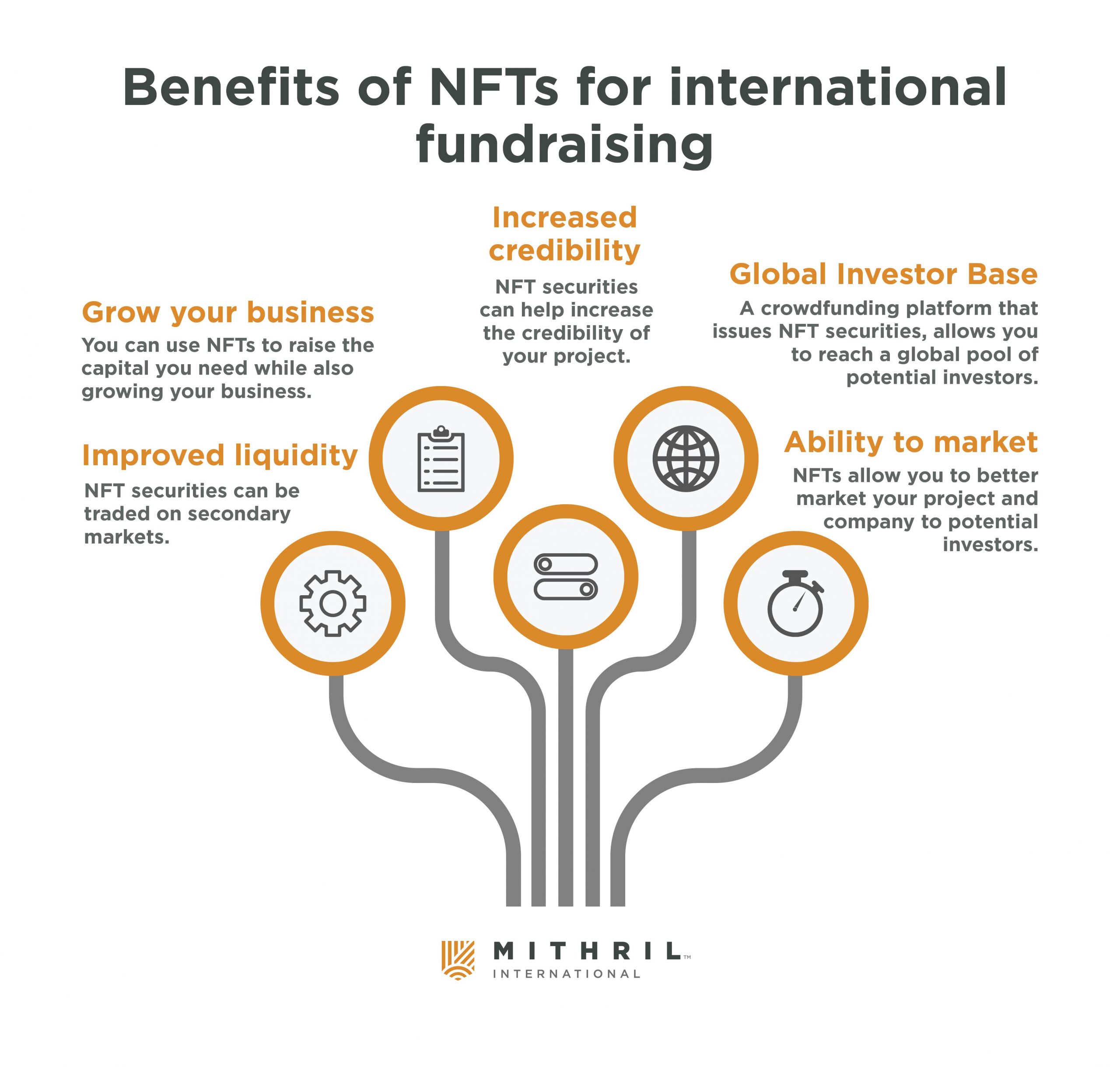

NFTs are a new and exciting way to raise money for your business. They offer a number of benefits, such as the ability to reach a global audience and tap into new markets.

However, there are also some risks that you should be aware of before issuing NFTs.

- You will need to include clear terms and conditions in your offering.

- With the right approach, you can use NFTs to raise the capital you need while also growing your business.

- NFTs can be issued via crowdfunding platforms in either a public offering or a private placement.

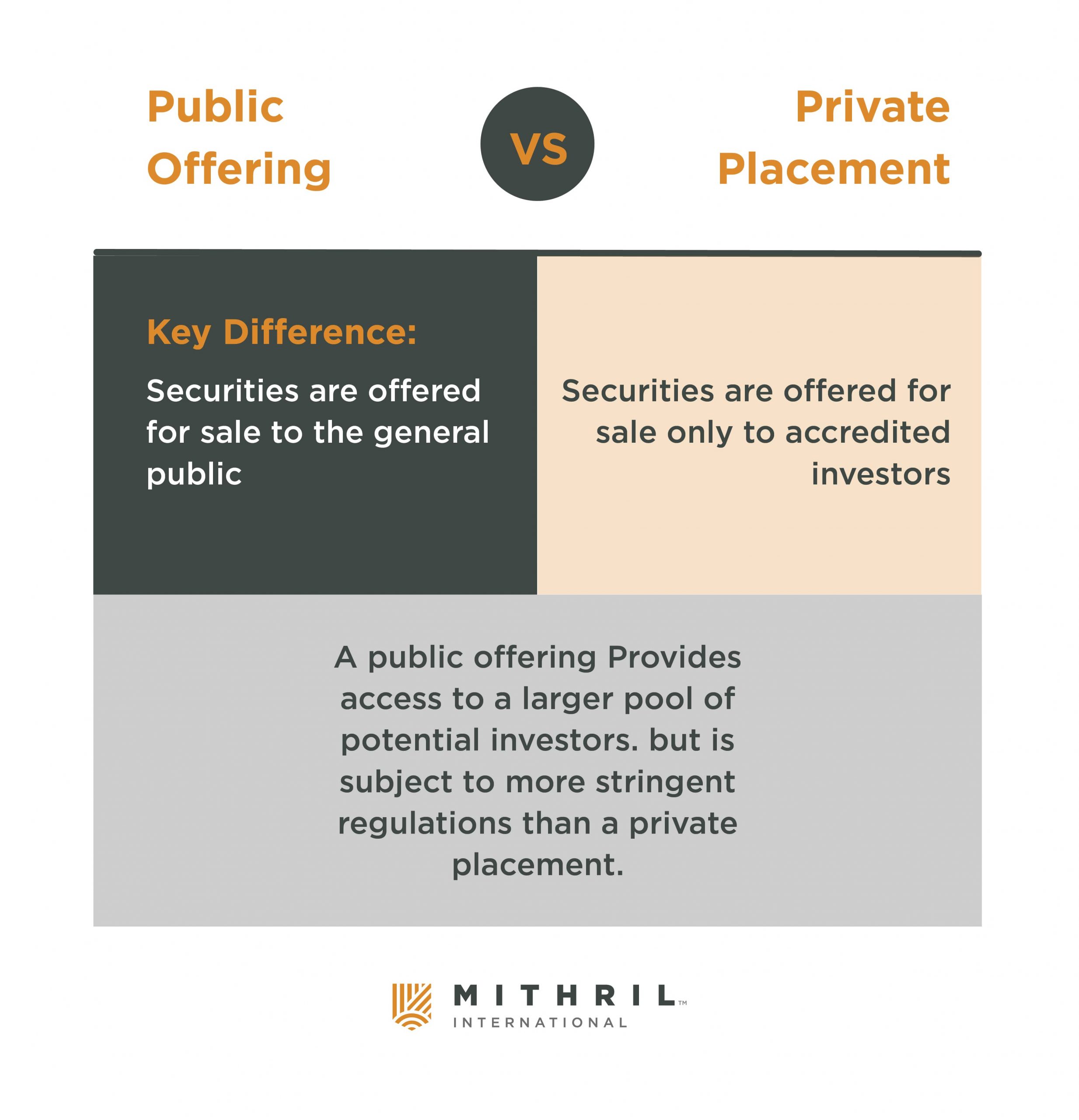

In a public offering, NFTs would be registered with the SEC and then offered for sale to the general public through an intermediary such as a broker-dealer or investment bank. In a private placement, NFTs would be registered with the SEC but then offered for sale only to accredited investors, which are defined as individuals or institutions that meet certain wealth or income thresholds.

The key difference between a public offering and a private placement is that in a public offering, securities are offered for sale to the general public, while in a private placement, securities are offered for sale only to accredited investors. The main advantage of a public offering is that it gives businesses access to a larger pool of potential investors. The main disadvantage of a public offering is that it is subject to more stringent regulations than a private placement.

NFTs and international fundraising

The new reality is that many traditional banks and other lenders are no longer willing to finance small businesses in these industries and companies due to the perceived environmental and social risks. This has been compounded by the increased regulation around the world in these industries. In order to raise capital, companies in these industries now need to look at marketing, promotion, and solicitation activities in order to find investors who are willing to invest in their business.

The use of NFTs provides a range of benefits including;

- Access to a global investor base: By using a crowdfunding platform that issues NFT securities, you will be able to reach a global pool of potential investors.

- Ability to market your project: The use of NFTs allows you to better market your project and company to potential investors. This is due to the fact that NFTs can be shared and promoted online.

- Increased credibility: The use of NFT securities can help increase the credibility of your project as it shows that you are willing to use innovative methods to raise funds.

- Improved liquidity: One of the benefits of using NFT securities is that they can be traded on secondary markets. This liquidity can attract more investors as they will know that they can exit the investment if they need to.

If you are planning on fundraising in the US, then you could consider using NFT securities. By doing so, you will be able to reach a wide pool of potential investors and market your project more effectively.

How can you give NFTs long-term value?

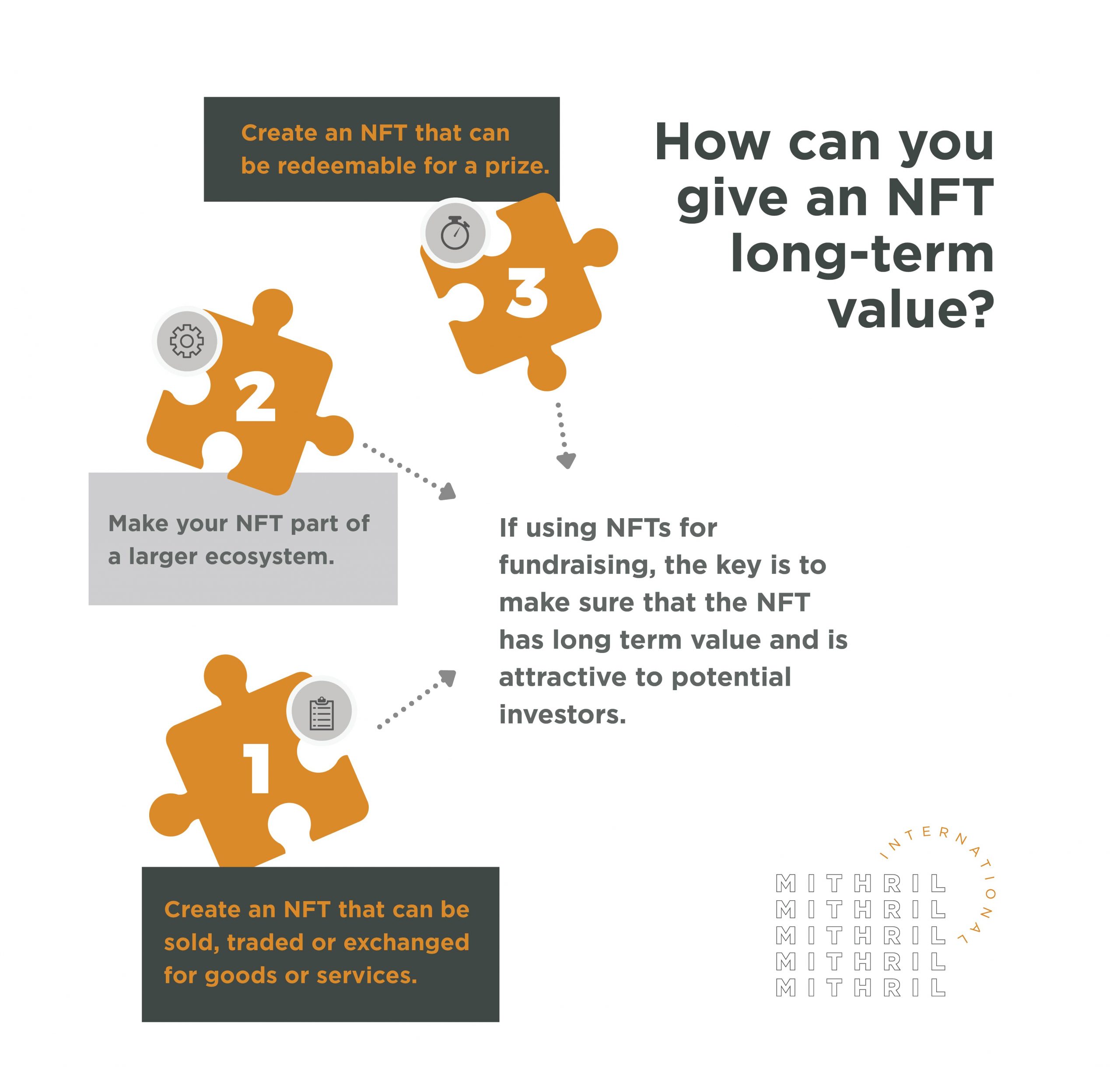

If using NFTs for fundraising, the key is to make sure that the NFT has long-term value and is attractive to potential investors.

This requires a certain amount of business and marketing planning. The NFTs should also be easy to transfer and manage. One way to do this is to create an NFT that can be sold, traded or exchanged for goods or services. The holder of the NFT would then have an incentive to keep it and use it.

Another way to create an NFT with value is to make it part of a larger ecosystem. For example, an NFT could represent a share in a business’s profits or a unit of a product. The holder of the NFT would then be able to participate in the success of the business or product.

Yet another way to give value to an NFT is to make it redeemable for a prize. The holder of the NFT would then have an incentive to keep it and use it. The key is to make sure that the NFT has value and is attractive to potential investors. It should also be easy to transfer and manage. If you are thinking about using NFTs to raise capital, there are a few things you should keep in mind:

- Make sure the NFT has value and is attractive to potential investors

- Consider making the NFT part of a larger ecosystem

- Make sure the NFT is easy to transfer and manage

- Be aware of securities laws when issuing NFTs

When done correctly, using NFTs to raise capital can be a great way to engage and communicate with potential investors and get them excited about your business. Just make sure you understand the risks and rewards before diving in.

The key is that the NFTs have to have long-term value to the holder and be seen as a good way to grow and engage with the company and its community. NFTs can provide a great way to raise funds while also engaging with potential investors and building your brand. Be sure to follow securities laws when issuing them, and include terms and conditions that are clear and easy to understand. With the right planning, you can use NFTs to raise the capital you need for marketing your main fundraising offer and growing your business.

NFTs & ESG in international fundraising

NFTs can take on different forms such as in-game items, digital art, or other creative content. For example, an in-game item could be a legendary sword that is only available through crowdfunding and is not attainable through any other means. This sword could be used as a status symbol among players and would hold value outside of the game itself.

Digital art could be created by well-known artists or artists and persons in the local community near to your oil & gas or mining project. These NFTs could then be minted on the blockchain and sold at a premium to potential investors and could also increase in value over time.

The use of NFTs to enable investors to connect with a company’s local community is a new idea. Especially in the context of ESG. one of the main criticisms of ESG is its lack of tangible and objective measurement. NFTs can serve as tangible evidence of the benefits of a project to the local community and possibly even regulators. Rather than reports and other “claims” NFTs and ownership via the blockchain could provide ongoing evidence of how local communities benefit from your project.

How to use Crowdfunding platforms to issue NFTs to US and international investors

Crowdfunding is a great way to raise money for your business. There are many different platforms that allow you to set up a campaign. Many crowdfunding platforms also have broker-dealer licenses. This means they can provide a wider range of fundraising activities in the US.

The most important thing to remember when creating an NFT offer for fundraising is that the NFTs must:

- have long-term value,

- be closely associated with the company’s brand.

- be issued to the US and international investors using a regulated US Crowdfunding platform.

NFTs can be used as a means of raising capital by using a crowdfunding platform to offer them to potential investors. When done correctly, issuing NFTs can be used to raise capital and grow your business.

When raising capital through crowdfunding, always remember the securities laws. NFTs that are offered for sale must be registered with the SEC before they can be sold to investors. If you’re planning on issuing NFTs as securities, it’s important that you follow all applicable securities laws. These laws vary from country to country, so be sure to consult with a securities lawyer in your jurisdiction. You’ll also need to include terms and conditions that are clear and easy to understand.

When issuing NFTs using a US Crowdfunding platform, you’ll also need to promote your offering and find investors who are interested in buying them. This can be done through online marketing, social media, or even word of mouth in line with legal advice.

By issuing NFTs, businesses can tap into a new pool of potential investors. By selling NFTs that are closely associated with the company’s brand, businesses can increase brand awareness and build long-term value.

Read Part I, Part II, and Part III of this article here.

Leave a Reply