DISCLAIMER

You will need to speak to US Securities counsel for a more detailed explanation. You have to consult a US Securities attorney to be able to work out how to promote your offering and find potential investors. Our aim is to discuss the differences that apply to non-US business owners compared to US business owners when raising capital in the USA.

In this newsletter, we explore how to raise capital from the US and international investors from the point of view of a non-US person who is raising funds for a non-US or international project. The business, whether it is oil & gas, mining, or agricultural export is classified as international in nature if it is not based in the US. See Part I of this newsletter here.

Owner managers should not use introducers/finders if fundraising in the USA

Using introducers and finders works for fundraising done outside the USA. In the USA however, finders or introducers are generally not allowed. To be able to use finders those finders have to be paid on a basis unrelated to successful investment and have to be unrelated to things subsequent to the introduction of the potential investor. But even this position is not evident across different states.

Using a finder or introducer in the USA for fundraising exposes the person doing the fundraising to legal risks and liability in the US. Because if investors complain or file a legal action, the owner-manager has to return all money raised plus interest.

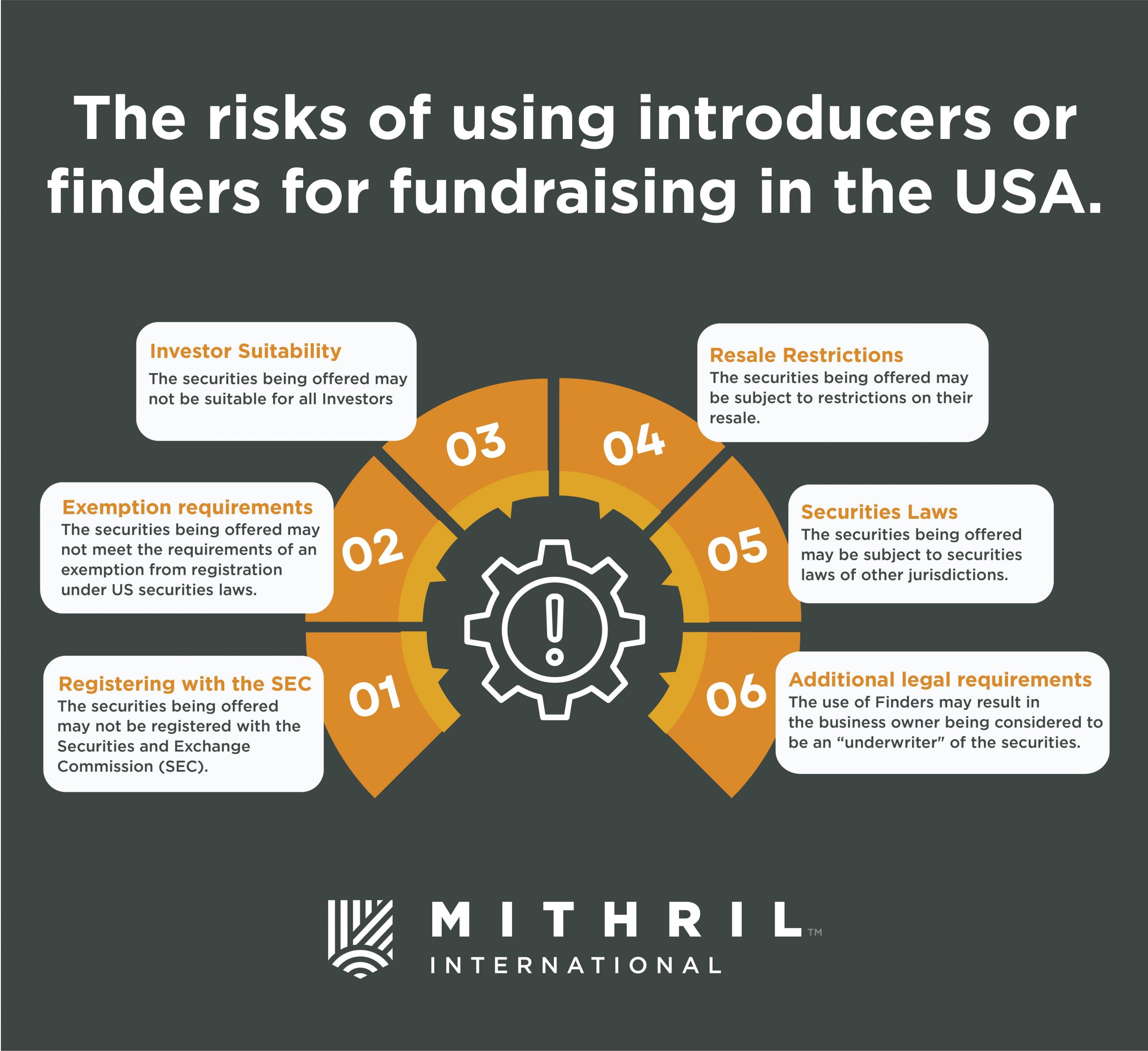

The risks of using Introducers or finders for fundraising in the USA

It is unclear if a finder can be used in the USA even if they are paid on a basis unrelated to successful investment and are unrelated to things subsequent to the introduction of the potential investor. As a result, it is advisable not to use Finders when fundraising in the USA.

Even if you are able to use Finders in the USA, there are significant legal risks associated with doing so. These risks include:

- The securities being offered may not be registered with the Securities and Exchange Commission (SEC), which means that they may not be lawfully sold in the USA.

- The securities being offered may not meet the requirements of an exemption from registration under US securities laws, which means that they may not be lawfully sold in the USA.

- The securities being offered may not be suitable for all investors, which means that some investors may not be able to invest in them.

- The securities being offered may be subject to restrictions on their resale, which means that they may not be able to be resold in the USA.

- The securities being offered may be subject to securities laws of other jurisdictions, which could make it difficult or impossible to resell them in the USA.

- The use of Finders may result in the business owner being considered to be an “underwriter” of the securities, which would subject them to additional legal requirements and risks.

The legal positions in the US vary by state and sometimes by the law firm. One can always rely on specific legal advice. Given that I am not a US counsel I suggest that owner-managers plan to market their investments without the use of finders.

Finding investors who want to invest is the most difficult thing about international fundraising

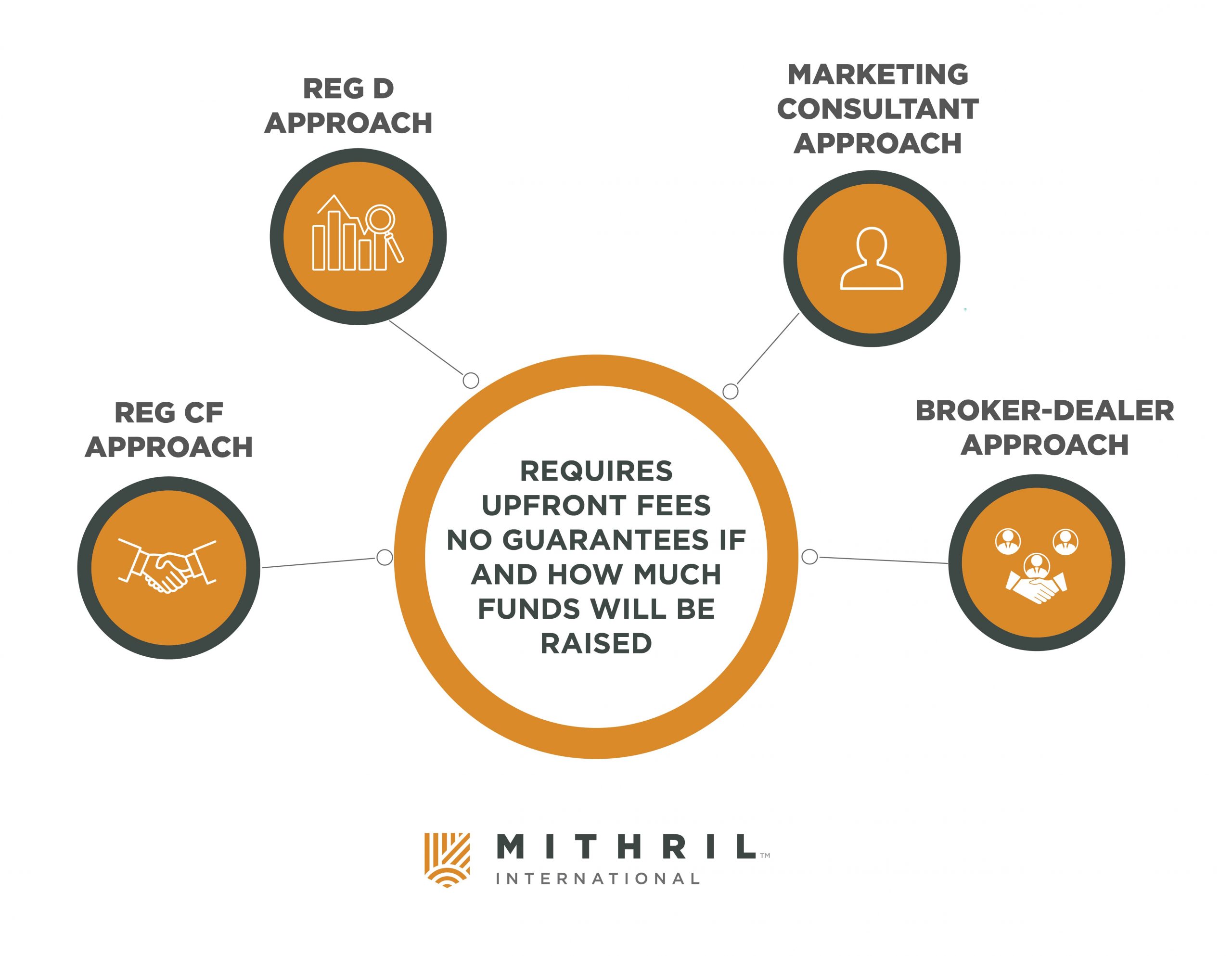

We speak to many owner-managers, who want to raise capital in the USA and yet do not have any funds for marketing, promotion, or the legally approved promotional documents that are needed to find investors and raise capital in the USA. RegCF, RegD, and marketing consultants, and using a US broker-dealer are all approaches that require upfront fees, and there are no guarantees if and how much funds will be raised.

These service providers do not enter into contingent arrangements where they only get paid upon successful fundraising. So the bottom line is if you want to carry out fundraising in the USA you need to have money for legal fees, promotion, and sales and marketing.

How to find the potential US and international investors

So how exactly would one go about finding investors and raising funds from them?

Promotion

There is a prohibition against general solicitation. General solicitation means putting promotional material of your investment offer on websites, social media, email, or advertisements. Promotion is best carried out by licensed broker-dealers who can distribute promotional materials to accredited investors. If the management team is carrying out business development they will have to work in tandem with the broker-dealer as prescribed by US counsel.

Marketing

Finding the US and international investors can be a challenge, but there are a number of ways to go about it. The most important thing is to be clear about your offer and to make sure that it complies with securities laws. Your company, your firm, and your opportunity will need a marketing plan, especially if doing Crowdfunding, RegD, or RegA+. This could include online marketing, content marketing, attending investor conferences or webinars, going on investor roadshows, or organizing your own investment events. Your pool of potential investors will be huge, and marketing to them will require strategic communication and engagement with them. It can also mean determining by analysis the right types of investors.

Building trust and engagement cannot be done overnight. This is why in some cases marketing communications, not of your fundraising but of your company and how it adds value is important before fundraising. Building your brand and community is therefore best done long before fundraising is needed.

You need to hire a marketing company in order to have a successful RegCF or RegD or another fundraising. It is not just a matter of engaging and onboarding to a Crowdfunding platform. Most Crowdfunding platforms won’t market your deal, that is they won’t do all the work needed to find potential investors and introduce them to your deal on the platform. You need legal counsel and a marketing company to help you understand how to do it.

There are many third-party marketing companies that do this work and are effective. They require upfront payment with no guarantee of funds being raised. Your US Securities lawyer will likely have recommended third-party marketing companies depending on whether you are fundraising in the US using RegCF, RegD or Reg A+ or others.

Solicitation or Selling

Once you have done marketing and found some US and international investors, you will need to do solicitation or selling. You may also need to engage in more traditional forms of selling, such as making phone calls, sending emails, or even meeting face-to-face with potential investors. The key here is to be clear about what you are offering and to make sure that your offer and the way you are communicating your offer it is compliant with US securities laws.

Selling to US investors has to be done by a licensed broker-dealer. Selling goes beyond introducing and requires “closing” the transaction. Engaging the right broker-dealer is important and that firm will assist with sales but they may not engage in upfront marketing to find potential investors.

The Marketing required depends on the way you are fundraising

To market a fundraising offer in the US you need a legal way or platform to do this. Some platforms that can be used to enable potential investors to interact with your offer include;

- RegCF Crowdfunding platforms

- US broker-dealer.

In both cases, you also need advice from a US Securities lawyer.

Owner managers searching for a single Joint Venture partner

Sometimes owner managers just want to find a single strategic JV partner, who will invest in your operation and bring capital, operational experience, and capability. Investing in your company can lead to issues with banking compliance, and source of funds and have implications for access to private banking services. So using an international private investment fund adds value to being able to take on a JV partner who is also an owner-manager.

See Part I of this newsletter here.

Leave a Reply