DISCLAIMER

You will need to speak to US Securities counsel for a more detailed explanation. You have to consult a US Securities attorney to be able to work out how to promote your offering and find potential investors. Our aim is to discuss the differences that apply to non-US business owners compared to US business owners when raising capital in the USA.

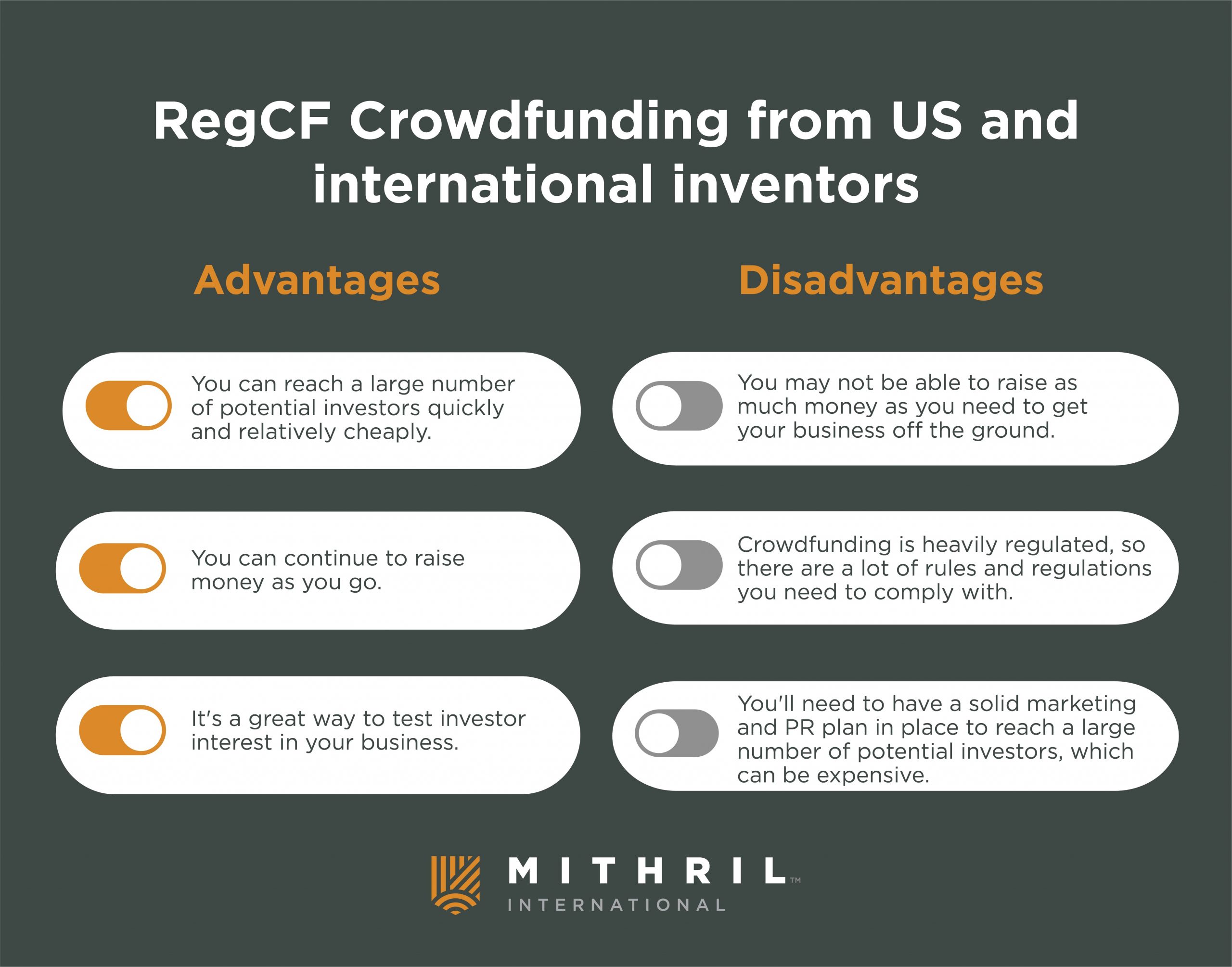

RegCF Crowdfunding from the US and international investors

Crowdfunding is a securities offering in which securities are sold to raise capital for a business. In the United States, securities must be registered with the Securities and Exchange Commission (SEC) before they can be sold to investors. There are two ways to register securities: through a public offering or through a private placement. In a public offering, securities are registered with the SEC and then offered for sale to the general public through an intermediary such as a broker-dealer or investment bank. In a private placement, securities are registered with the SEC but then offered for sale only to accredited investors, which are defined as individuals or institutions that meet certain wealth or income thresholds.

Crowdfunding is the use of small amounts of capital from a large number of individuals to finance a new business venture. It’s securities-based, which means you’re offering securities (usually equity) in your company in exchange for investment funds.

Advantages:

- You can reach a large number of potential investors quickly and relatively cheaply.

- You can continue to raise money as you go, which can be helpful if you have a long sales cycle or need to hit certain milestones before you can start generating revenue.

- It’s a great way to test investor interest in your business and gauge whether or not you’ll be able to raise larger sums of money from professional investors down the road.

Disadvantages:

- You may not be able to raise as much money as you need to get your business off the ground.

- Crowdfunding is heavily regulated, so there are a lot of rules and regulations you need to comply with. This can be costly and time-consuming.

- You’ll need to have a solid marketing and PR plan in place to reach a large number of potential investors, which can be expensive.

When doing a US crowdfunding, upfront costs are required to be able to market the offer to the US and international investors. This marketing is needed because you need to both find and locate potential investors and also communicate and engage with them. Marketing firms that do this will use their existing databases of investors but they have to work to understand your company, your offer, and how and to whom to market your crowdfunding offer to.

In order to successfully market your crowdfunding offer a commercially sensible and logical marketing plan has to be formulated and executed. To some extent even after the marketing company has found and located investors you may still need to “close” the sales. You may therefore also need a US Broker dealer to send potential investors the promotional materials and close out the leads and introductions generated by the marketing company.

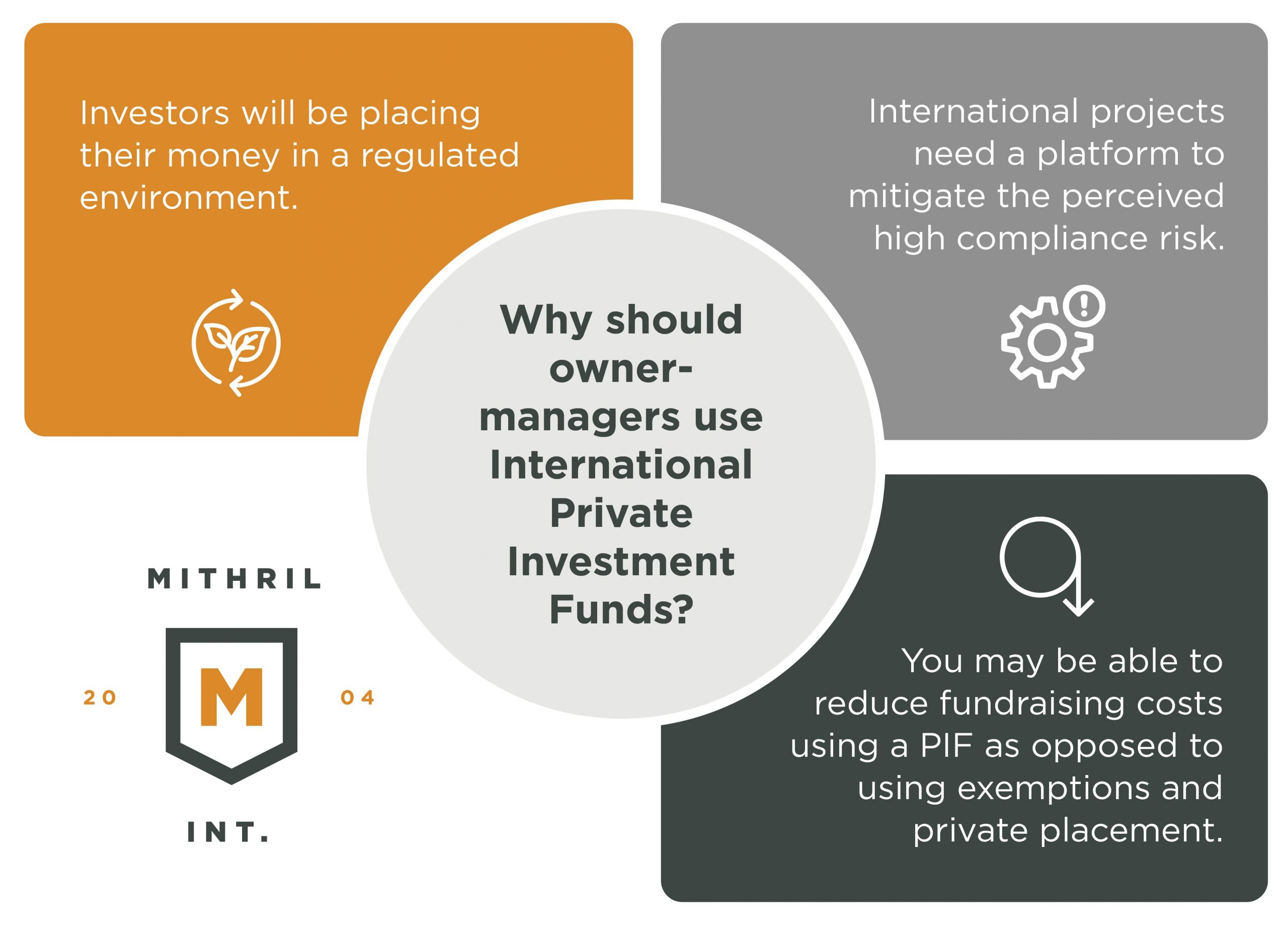

International Private Investment Fund

Owner managers of non-US businesses need to use international private investment funds to raise funds from the US and accredited investors. Whether working in tandem with a Crowdfunding platform, a broker-dealer, or both, marketing needs to be done to find the right potential investors and get the offer documents to them. If using a US crowdfunding platform the marketing can be for the US and international investors. The main point being made here is, that marketing is a separate activity that needs to be done in order to execute a successful fundraising project.

Public US SEC exemptions that allow solicitation

Exemptions from SEC registration sound good and like they will save a lot of costs. Being able to operate under an exemption works well for US persons but for non-US owner-managers, the situation is different. There are upfront costs to fundraising. Using a public exemption can be costly and US Securities counsel will explain why this might be the case. Above all, an international project that is outside the US is going to be a higher risk for US investors. So an exemption from having a registered or regulated fund manager is not going to help an owner-manager who is raising funds for an international business outside the USA.

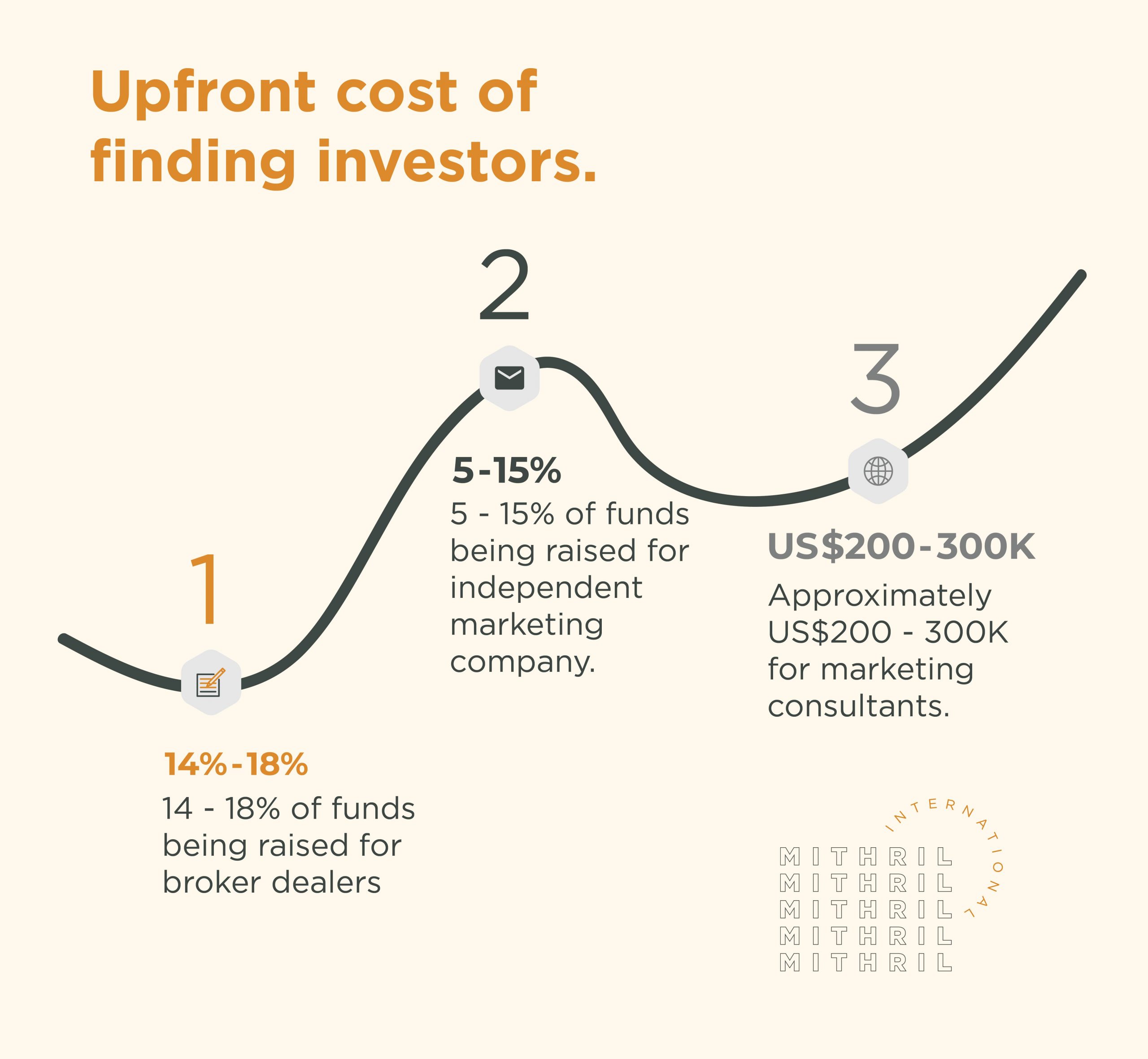

Upfront Costs of finding investors

The upfront costs of finding investors can be;

1️. 14%-18% of funds being raised for broker-dealers

2️. 5-15% of funds being raised for an independent marketing company

3️. Approximately US$200-300K for marketing consultants.

If you don’t have an existing community of investors and you want to raise capital in the US and internationally, these are the upfront costs you need to be able to pay. Whether you are Crowdfunding or using a broker-dealer or both. If you want to save these costs then you need to be able to do the marketing and finding of investors yourself in line with legal advice.

Owner managers do not want to incur upfront costs

To many owner-managers, there is nothing worse than paying out consultancy fees to someone who gets paid upfront and delivers nothing.

So fundraisers and owners know this and they, therefore, look for finders, or introducers who only earn a commission if they bring successful investors.

Outside the US, the use of finders or introducers for finding investors who want to invest in a particular project is the way things are done. This way the owner-manager, does not incur any upfront costs.

If you want to raise capital in the US, you cannot do it unless you have funds to pay for legal fees and promotion, marketing, or the finding of investors. These costs are upfront costs.

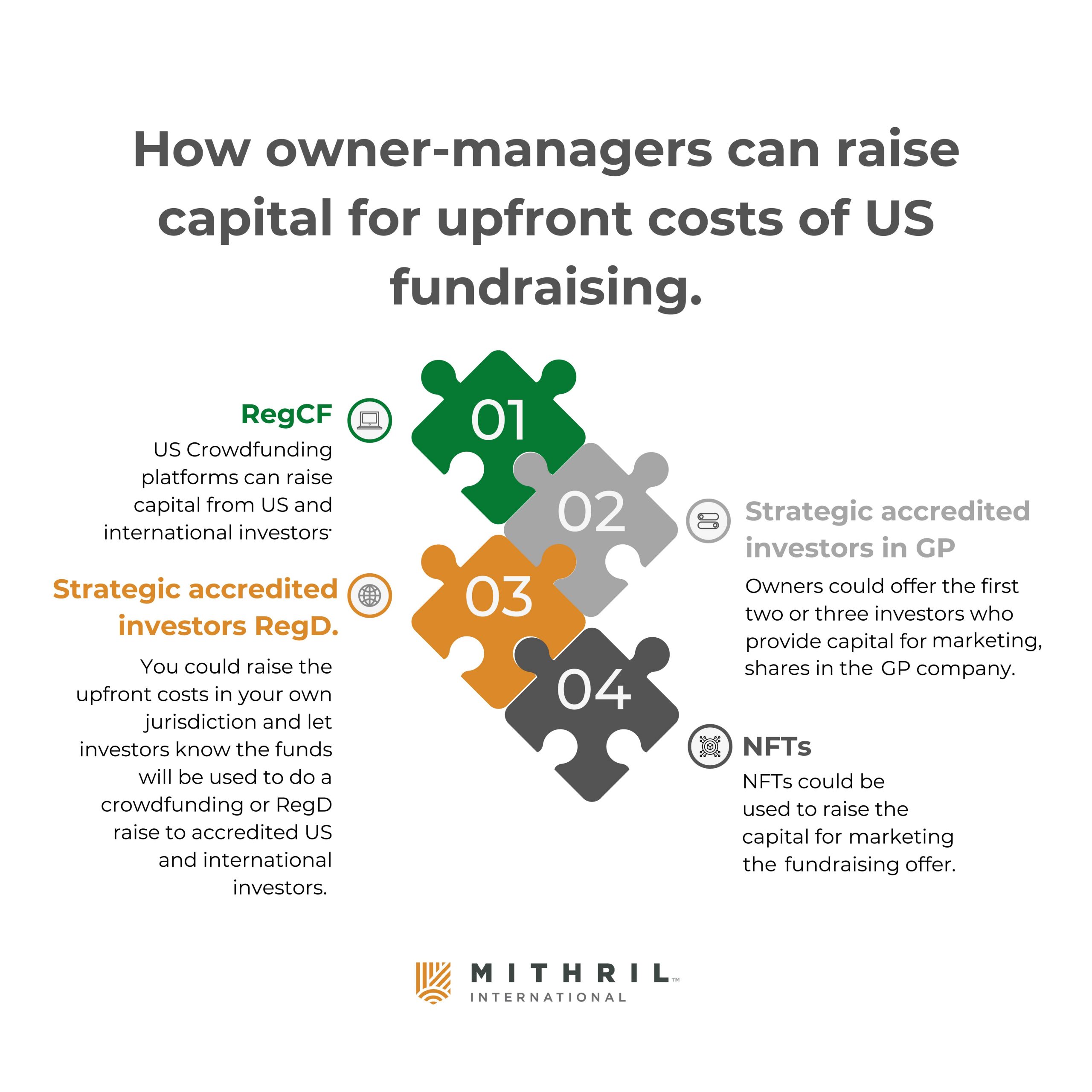

How owner-managers can raise capital for upfront costs of US fundraising

Some owner-managers may not have US$200-300K for upfront marketing costs for fundraising. Some people would say that if that is the case, then perhaps you should not be fundraising. However, owner-managers can break this problem down to its fundamental components and derive solutions organically. Four ideas owner managers could explore;

RegCF

US Crowdfunding platforms can raise capital from the US and international investors. Some crowdfunding platforms have a range of resources and contacts including Securities counsel. If an owner-manager had at least US20-30K for initial advice they may be able to get an offering onto a Crowdfunding platform. Counsel will advise on letting investors know the first US200-300K raised will be spent on raising further funds. Some counsel can also advise on reducing the costs of providing the key promotional documents that investors need by law, especially in relation to crowdfunding offers. Not all businesses fit this approach. If there is however a real underlying asset and operations on the balance sheet and treaty protections for US or Canadian companies holding the investment, there may be possibilities. There could also be an incentive for CF investors who are the first to invest in an offer like this.

Strategic accredited investors RegD

Another approach could be to raise the upfront costs in your own jurisdiction and let investors know the funds will be used to do crowdfunding or RegD raise to the accredited US and international investors. With an underlying asset like an oil & gas field or a mining operation, there may be more possibilities of raising the funds needed for marketing rather than seeking to raise the entire US$20-30M in your jurisdiction. The strategic investor knows the jurisdiction and is putting up capital and being asked for a lot less than the overall amount being raised.

Strategic accredited investors in GP

Two or three strategic investors could be awarded voting or nonvoting shares in your General Partner company. Owners could offer the first two or three investors who provide capital for marketing, and shares in the GP company.

NFTs

Owner-managed Oil & gas, mining, and agricultural export companies are all going to have their cost of finance impacted by ESG. NFTs could be used to raise the capital for marketing the fundraising offer.

Leave a Reply