The owner-manager trying to raise funds in the US for a non-US business must reduce the risk of their investment offer if they want to raise funding of US20M or more from the USA and international investors. Investors are going to look at the risk of investing with you by looking at the relationship between the General Partner/ Fund manager and the investors in the fund.

The importance of the legal relationship between the Fund manager and the Investor

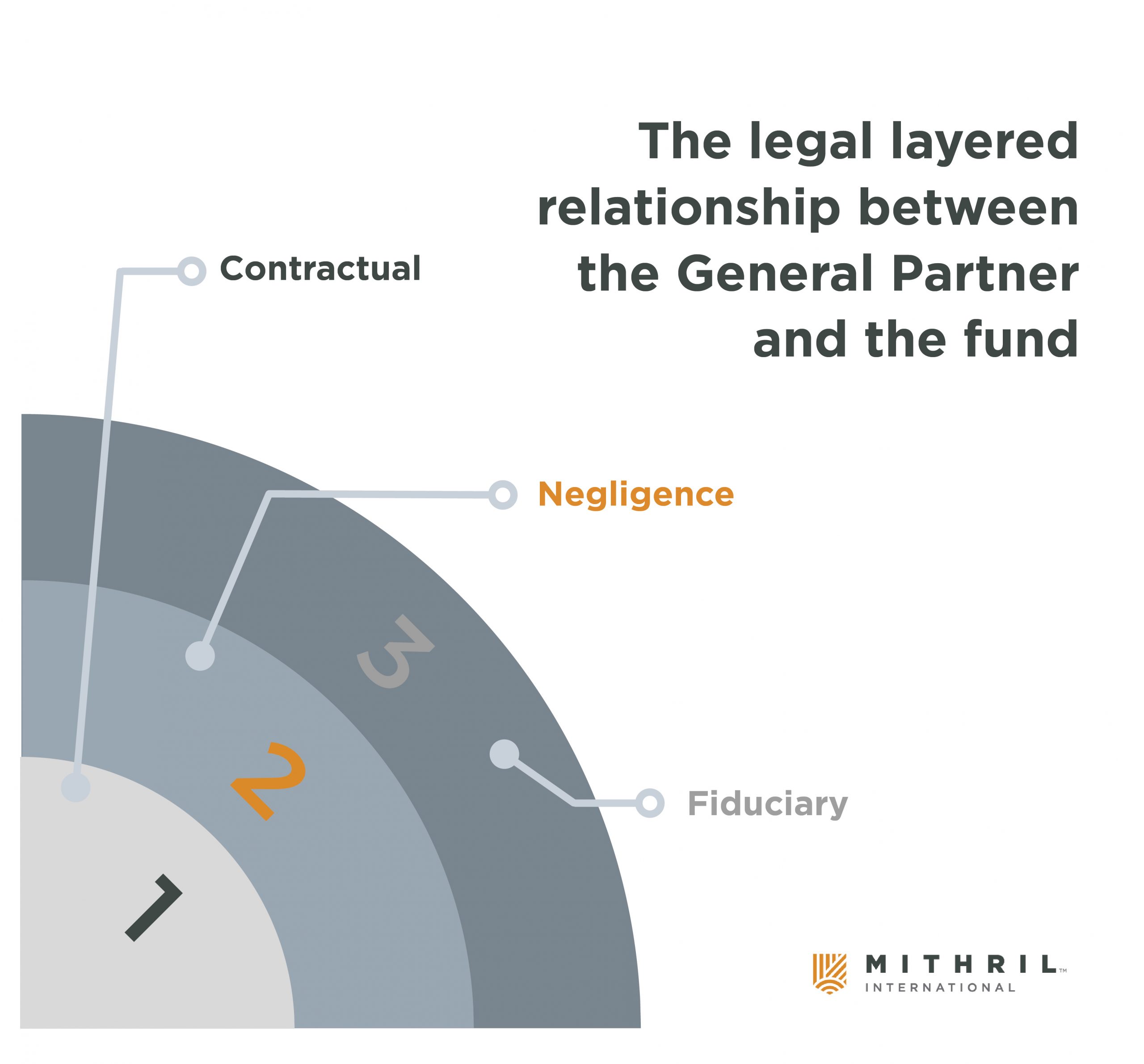

The legal relationship between the GP and the fund has a number of layers:

- Contractual

- Negligence

- Fiduciary

The Investors or likely their advisors will be looking closely at these layers. Their concern is mitigating risk and ensuring there is protection for investors in terms of:

- Operational risk

- Unreasonable failure or omission by management

- Conflict of interest

Trust – Investors need to be able to trust their fund manager and fiduciary duty

Fiduciary duty, trust, and transparency are of great importance when it comes to a non-U.S. proposition. If you don’t have complete faith and trust in your fund manager, then it is very difficult to ask U.S. investors to do the same. Fiduciary duty means trust. If a potential investor’s advisor cannot fully understand how their client’s interests are being protected then they will quickly look elsewhere. Many investors have advisors who will assess investment opportunities objectively. So, it is important to present clear, tangible, and strong investor protection and risk mitigation.

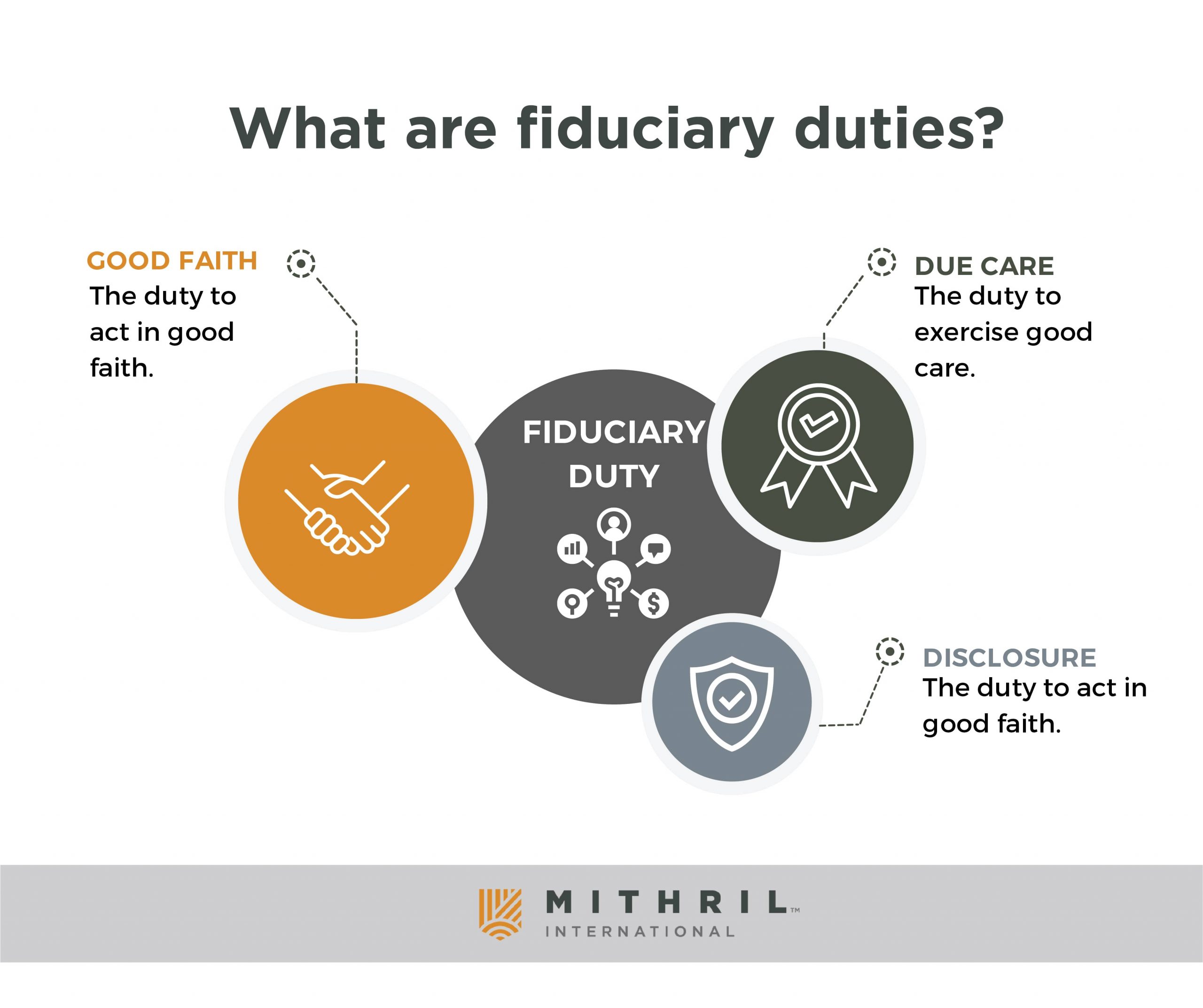

Investors are going to look at the risk of investing with you by looking at the relationship between the General Partner/ Fund manager and the investors in the fund. Fiduciary duties are generally imposed by US state law on directors of companies. These fiduciary duties include the duty to:

- Act in good faith.

- Exercise due care

- Disclose material information.

Contract, negligence, and international arbitration.

US investors and their advisors will know that there are well-established contractual mechanisms in international law in place that will act to protect their rights under the contract between the GP and investment fund. The track record of international arbitrations to settle and recover damages for contractual disputes is well known.

International arbitration is well established between the US and Latin America and works extremely well on many levels. There are many law firms and lawyers in Latin American and U.S. traditions that have extensive experience in arbitration.

In matters of contractual and factual negligence, therefore, the law of international arbitration works fairly well. Though it can be somewhat expensive.

Generally, a fund and investors can use arbitration clauses to resolve litigation.

The civil common law tradition does not cause friction to an effective international arbitration. As long as you choose to counsel with experience, well-drafted arbitration provisions are valuable to investors and owner-managers.

Fiduciary duty

The Fiduciary duty is a key element in attracting investment into a non-U.S. business.

By ensuring that the fund manager/GP has a fiduciary duty to the investors, you can help to attract more investment into your business.

The Fiduciary duty is a very important common law duty known to Anglo-American jurisprudence. It requires, at a minimum, that a fiduciary manager act with the utmost good faith and loyalty and put the interests of the beneficiary first. In this case, the GP is the fiduciary, and the beneficiary is the investor.

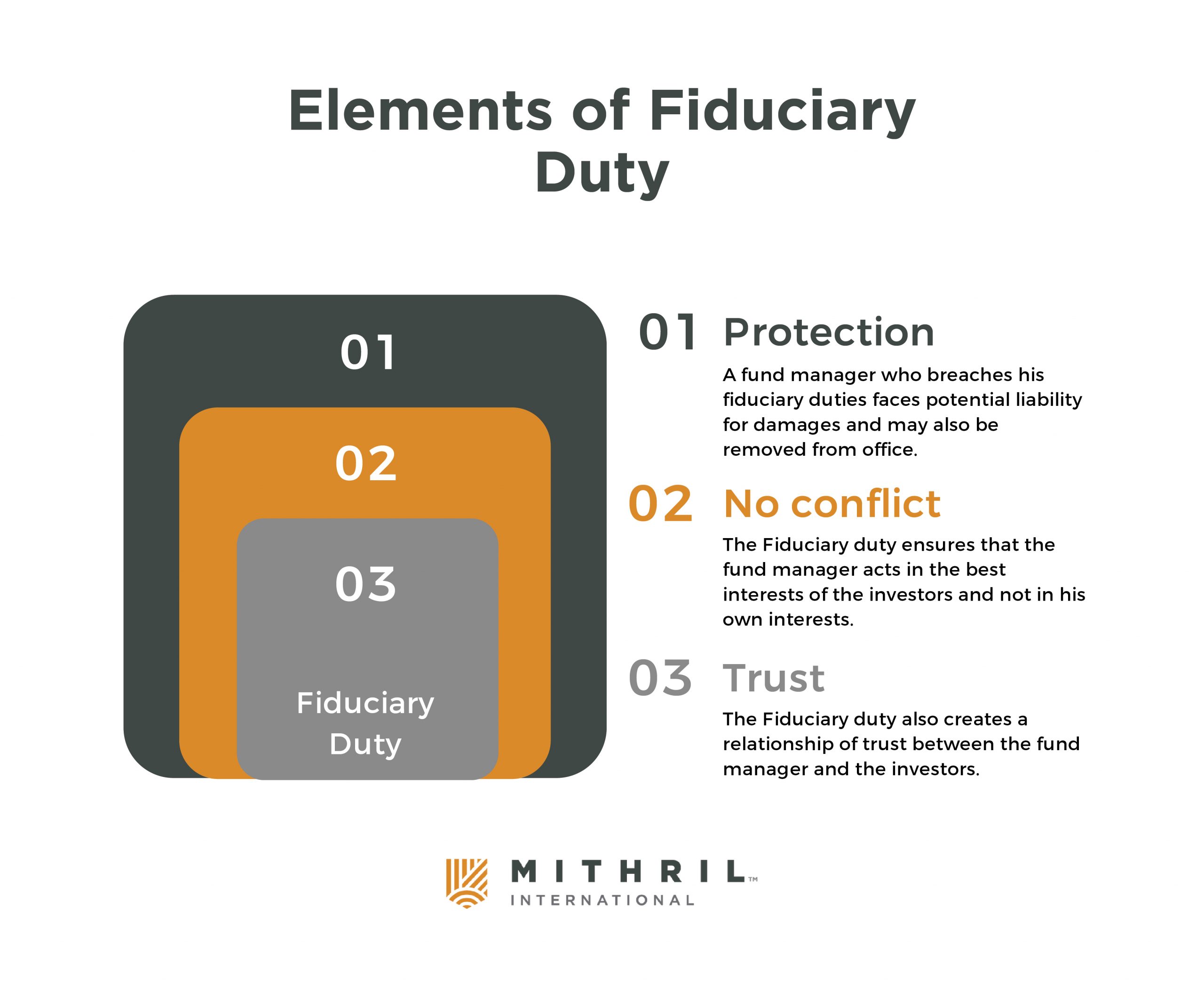

✅ Protection – A fund manager who breaches his fiduciary duties faces potential liability for damages and may also be removed from office.

✅ No conflict – The Fiduciary duty ensures that the fund manager acts in the best interests of the investors and not in his own interests.

✅ Trust – The Fiduciary duty also creates a relationship of trust between the fund manager and the investors.

Investors need to trust that their fund manager/GP will act in their best interests and not misuse their funds.

There is no common law of equity in Latin America

In the USA and Caribbean, the fiduciary duty which emanates from the common law of equity is the most powerful layer of legal protection for investors. Lawyers and owners in Latin American nations need to be aware there is no law of equity and hence no fiduciary duty in the Latin American civil law systems. This is going to be an issue for US investors and their advisors. They are able to rely on the law of equity when they make investments in the US and other common law jurisdictions.

In the US, many funds or investment managers will restrict the fiduciary duty in investment agreements as much as legally possible but in many states, the common law will still ultimately provide protection for the investors. This approach is not going to be open to non-US owner-managers who may be perceived as presenting an opportunity that has much less investor protection.

US investors may sometimes be more relaxed about attempts by U.S. managers to restrict fiduciary duty. In many jurisdictions in the US fiduciary duty is not only common law it is statutory. In Florida, the fiduciary duty consists of a “prudential” fiduciary duty, which is an extremely high if not the highest standard of protection in the financial services industry.

Fiduciary duty offers greater protection than contractual protection

It is standard that contracts are required for all commercial arrangements in business today. Contracts are however limited in their ability to deal with unforeseen circumstances. Contracts that try to comprehensively address many unforeseen circumstances, tend to be very complex in practice.

For example, a non-US owner manager seeking to raise funds from US investors for a non-US business should consider including an express fiduciary duty in the investment management agreement between the fund and the manager. The Fiduciary duty should be at least as protective as the duty under Florida Statutes.

Including an express fiduciary duty in the investment management agreement between the fund and the manager will help to reduce the risk of investing for US investors.

The fiduciary duty in an international context

When US investors are investing in a non-U.S. business that is managed by a non-U.S. owner-manager, there is the risk that the fiduciary duty will not be practically effective. This is why many Latin American owner managers establish international private investment funds in tax-neutral, common-law jurisdictions like the Bahamas, Cayman, and BVI. So that the fiduciary obligations can be enforced to some extent in an international context. The tax-neutral platform is used so that the entire business is not unnecessarily subject to US taxation. The use of an international private investment fund structure also allows the owner-manager to pool together many international investors which would otherwise be impractical.

One of the key reasons why some owner-managers choose not to set up a fund is the lack of understanding of the fiduciary duty and how it can be practically enforced in an international context. Fiduciary duty is the legal obligation to act in someone else’s best interests. In the context of investing, this means that GPs/fund managers have a duty to their investors to make decisions that are in the investors’ best interests, rather than decisions that benefit only the fund manager or other stakeholders.

Leave a Reply