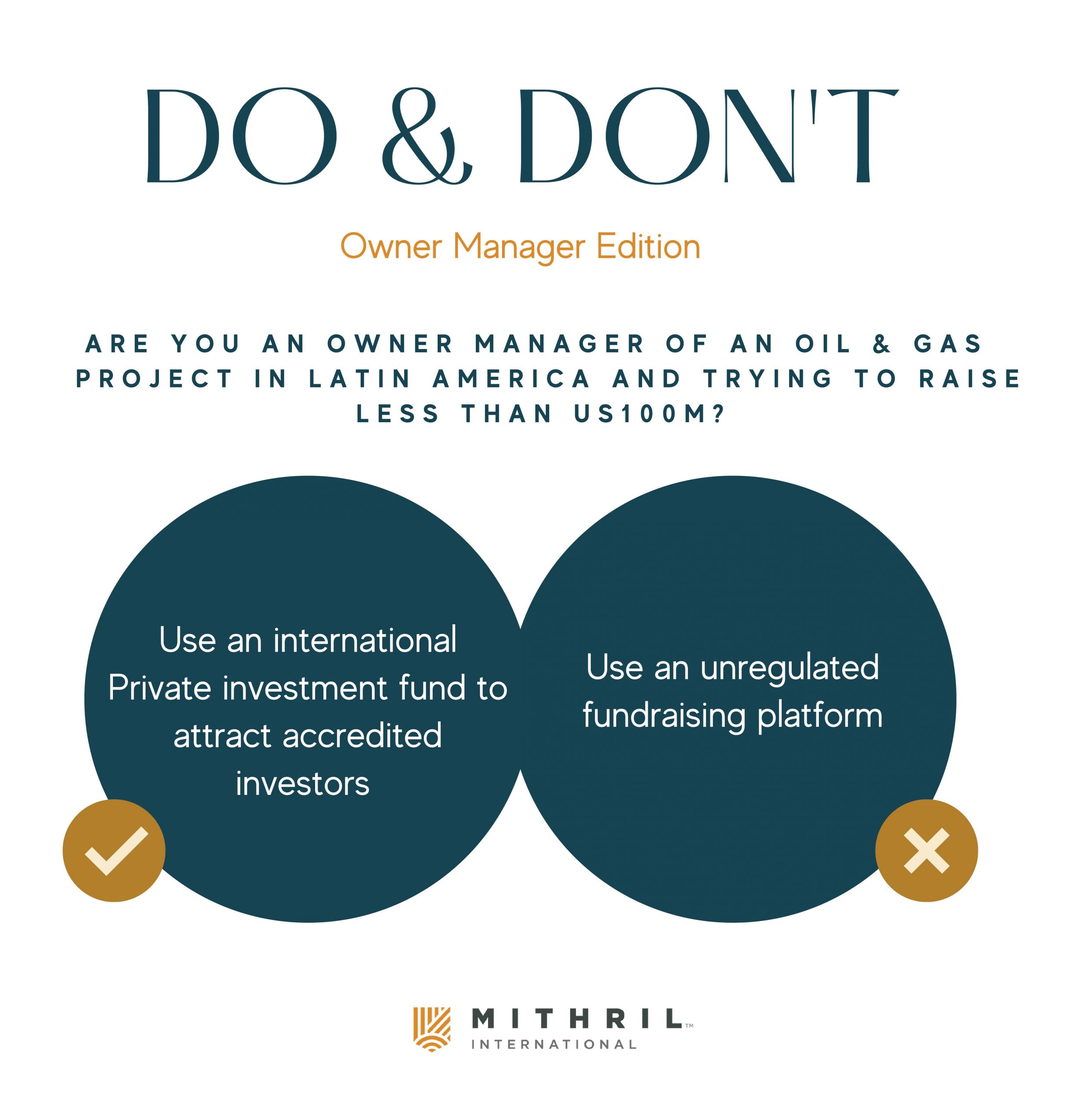

If you are an owner-manager of an oil & gas or mining project in Latin America and you are trying to raise less than US100M to grow your business, there are many potential investors in the US who may be interested. However, you will need a well-structured international private investment fund to successfully attract accredited investors to your international project.

The reason you need a captive insurance company is to reduce the compliance risk and operational risk of your business which is not based in the US. Accredited US investors see non-US projects that are closely held or owned and operated by management as “high risk”.

High operational risk

Operational risk is the chance that something will go wrong with the management or operation of your fund. Captive Insurance companies can help to protect your fund from this type of risk by providing insurance for your employees, contractors, and other third parties. This can help to ensure that your international private investment fund is able to continue operating even if there are problems with some of the people involved.

High compliance risk

Compliance risk is the chance that your fund will be subject to regulatory action. Captive Insurance companies can help to reduce this risk by providing insurance for compliance-related expenses. This can help to keep your fund in compliance with regulations and avoid costly penalties.

Both risks can be significant deterrents for US investors. By using a Captive Insurance company, you can show that you are taking steps to mitigate these risks and make your fund more attractive to potential investors.

Who exactly will be flagging your project as “high risk”?

- The US accredited investor.

- The potential investors’ relationship manager at his or her US private bank.

- The compliance department at the potential US investors private bank.

- The US advisors of the accredited investor.

They will all view your proposal or investment as “high risk” even if the economics of your project is better than a comparable US domestic investment.

A Captive Insurance company can reduce both the compliance risk and the operational risk for US investors. Thus, making your investment much more attractive to USA accredited investors. Especially for projects seeking to raise more than US10M from the USA and international investors.

Why make Captive Insurance a part of an international private investment fund?

There are many benefits to having a captive insurance company. Captives can help to:

- Manage risk

- Increase control

- Provide tax advantages.

The use of a captive insurance company can provide significant advantages for international private investment funds. These advantages can help to increase the chances of fundraising and give the owner-manager more control. In particular, the use of a captive insurance company can help to manage risk by providing stability and predictability in premiums and claims payments. Captives can also help to increase control by giving the owner-manager more direct input into how the insurance company is run. Finally, Captives can provide significant tax advantages, which can further increase the attractiveness of the fund to potential investors.

Thus, the use of a Captive insurance company can be a valuable tool for international private investment funds. By taking advantage of the benefits that Captives offer, funds can increase their chances of success in raising capital and provide greater control to the owner-manager.

Captive insurance as part of an international private investment fund can help an owner-manager balance maintaining control and investor protection. In an international Private Investment Fund, the investor is not involved in day-to-day management. The owner-manager is focused on managing the local operation. The Captive insurance company can provide investors with substantial protection against loss and fraud. With an independent board of directors, the captive insurance company just needs to ensure the right range of operational risks.

Captive insurance also provides an extra layer of security for the international private investment fund. By using a Captive, the manager does not have to rely on external insurers who may be unfamiliar with the local market. The Captive can be designed to specifically meet the needs of the international private investment fund and its investors.

In particular, the use of a Captive can help to:

- Balance maintaining control and investor protection.

- Improve risk management.

- Provide an extra layer of security.

- Tailor insurance coverage to specific needs.

These advantages can help to increase the chances of fundraising and give the owner-manager more control.

Benefits of Captive Insurance

A captive insurance company is an insurance company that is wholly owned and controlled by the same entity that it insures. Captives are used to insure the risks of their owners, which may be a corporation, association, or individual. There are many benefits to having a captive insurance company:

🔘 Reduced cost of insurance – By self-insuring through a captive, the owner can avoid the high premiums charged by commercial insurers.

🔘 Improved risk management – A captive can help its owner develop a more proactive approach to risk management.

🔘 Increased control over claims – When claims are paid by a captive, the owner has greater control over how they are managed.

🔘Tax advantages.

The advantages of Captive insurance for an international private investment fund are clear. By using a Captive, the owner-manager can maintain and retain more control while providing investors international private investment fund with substantial protection. This can help to increase the chances of successful international fundraising and enable the owner-manager to retain the necessary control over the international private investment fund. Captive insurance is an important tool for any international private investment fund.

How does Captive Reinsurance benefit owner-managers who manage PIFs?

If an owner-manager decides to use an international Private investment Fund and includes in the Offer memorandum/Investment prospectus a captive insurance company, a number of strategic benefits will be apparent that will increase the chances of raising capital using the Private Investment Fund and give the owner-manager more control.

The Captive reinsurance company can also provide opportunities for the international private investment fund to generate additional income and cash flow. For example, the Captive can reinsure risks with other insurers in the local market. This can create a profitable side business for the Captive, as well as provide a valuable service to the local market.

In summary, Captive insurance provides a number of advantages for international private investment funds. These advantages can help to increase the chances of fundraising and give the owner-manager more control. The use of a Captive can help to balance maintaining control and investor protection, as well as providing opportunities for generating income.

In part 2 of this newsletter, we will take a deeper dive into the benefits of a captive reinsurance company for making your international PIF successful.

Leave a Reply