International Fundraising: Captive insurance + International PIFs Part 2

As discussed in part 1 of this article, if you are an owner-manager of an oil & gas or mining project in Latin America and you are trying to raise less than US100M to grow your business, there are many potential investors in the US who may be interested. However, you will need a well-structured international private investment fund to successfully attract accredited investors to your international project.

You need a captive insurance company to reduce the compliance and operational risk of your business not based in the US. Accredited US investors see non-US projects that are closely held, or owned and operated by management, as “high risk”.

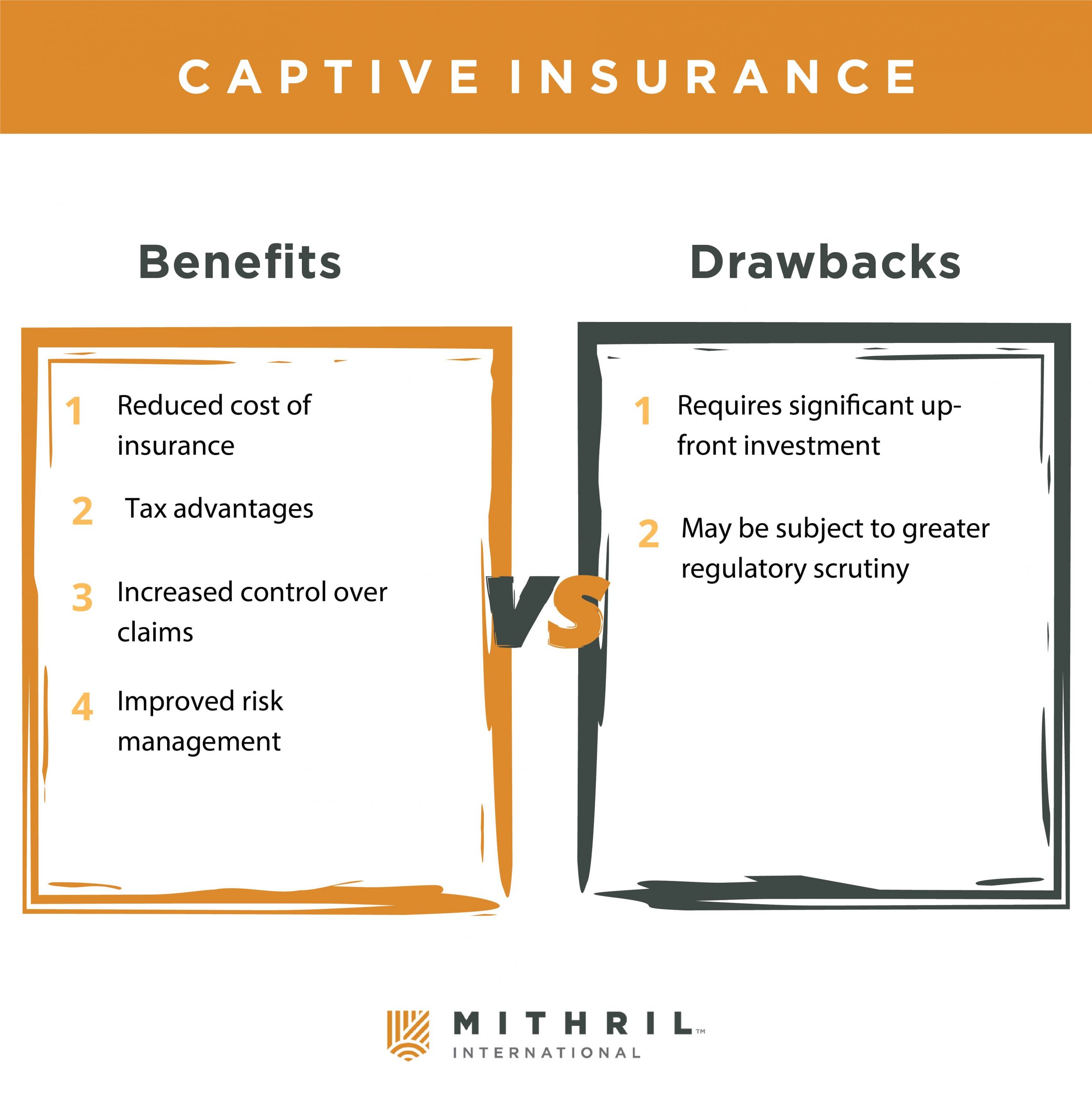

The Benefits of Captive Reinsurance

Using a Captive insurance company provides significant advantages for international private investment funds.

These advantages can help to increase the chances of fundraising and give the owner-manager more control. In particular, the use of a Captive can reduce project risk, offer more flexible risk management, and provide shareholders of the international private investment fund with greater control over the Captive insurer. These benefits can make a captive company an attractive option for international private investment funds looking to diversify their risk and improve their chances of success.

Captive insurance can give the owner-manager more control over how the business is run and how profits are distributed. This is because the Captive will be controlled by the owner-manager and independent directors. As such, the owner-manager will be able to make decisions about the direction of the business and ensure that profits are used in the most beneficial way. Investors will have more confidence in the independent directors on the board of the captive reinsurance company and thus more confident in the international project itself.

Tangible investor protection

The shares of the Captive insurance company can be issued to some strategic investors of the PIF. If there were a fraud event the Captive would pay out and the investor would be covered.

Reduced international risk

The Captive insurance company will insure the real economic and operational risks of the operating company. As Captive increases its financial balance sheet it will become stronger and the investors who are shareholders will benefit. The international risk of the project is then reduced as the captive insurance company and the project generates more cash flow.

The Captive can also help the international private investment fund control its risk management. The operating company has more flexibility if it includes a captive insurance company as its rules are not as strict as traditional commercial insurers. The Captive insurer is usually owned by the shareholders of the international private investment fund, and this gives them more control over how the Captive is run.

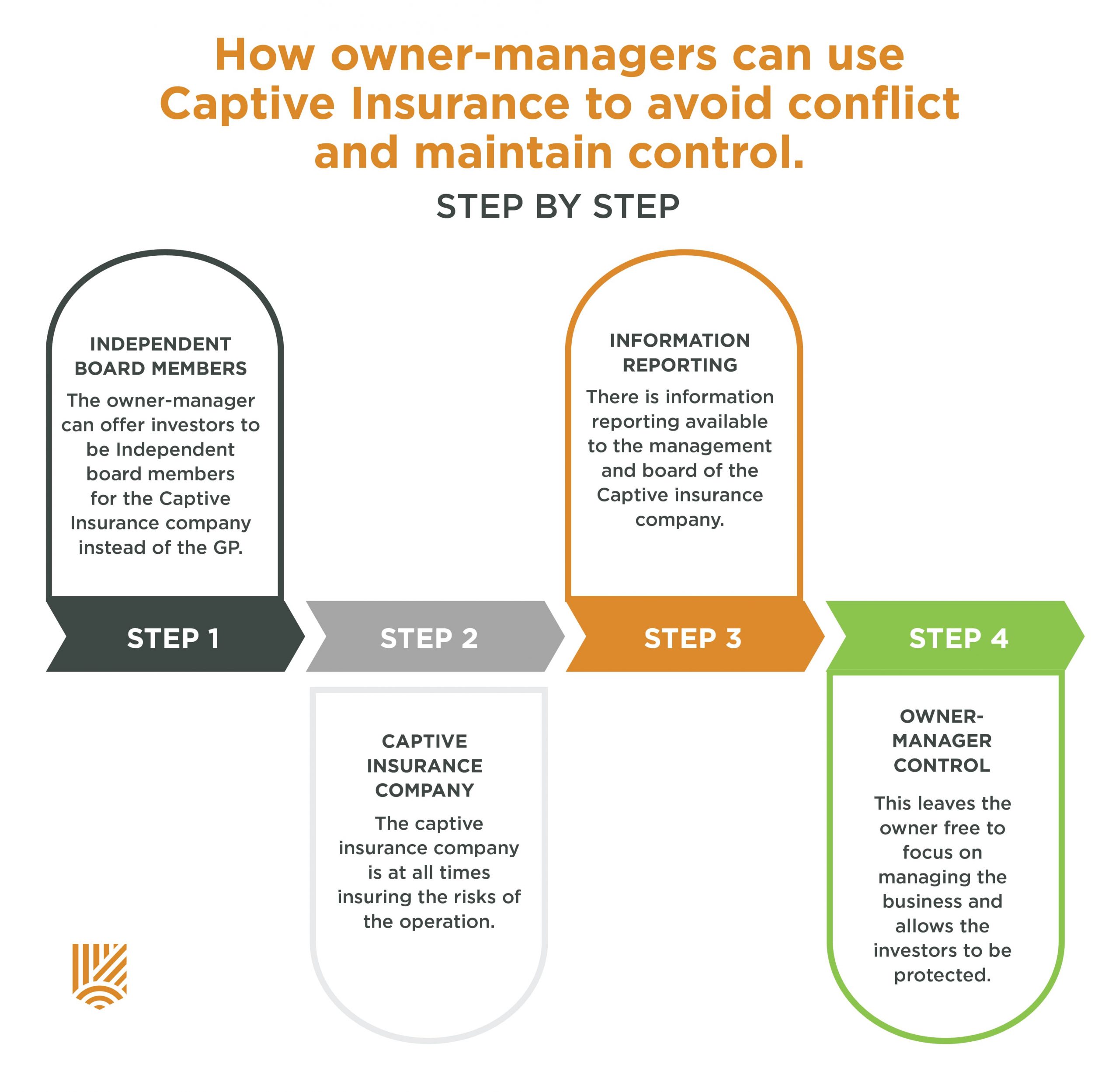

Less need for independent directors

The Captive reinsurance company can insure the local operating company against risks like business loss, key man insurance, and fraud loss. If there is an independent board in the captive reinsurance company investors will be more confident that there will be a payout in an event caused by the fund manager/owner operator. The owner-manager can thus make the case that there would be less need for independent directors on the border of the GP.

Investment agreement between fund and GP

Normally fund managers include clauses that create exclusions of fiduciary and other duties. This is an attempt by fund managers to reduce the potential for litigation liability and maintain control of the fund. If a captive insurance company is in place and committed to in the Offer Memorandum, investors may be less concerned with legal exclusion or restricting provisions in the investment agreement. Certainly with insurance in place, investors may be less likely to initiate litigation if there is an event.

The enhanced financial incentive for US investors

For US investors, the captive insurance structure is very tax efficient.

These tax efficiencies mean that holding shares of a captive insurance company is a very lucrative prospect for US persons. With many other international Investments, there is little or no tax deferral and income and profits are subject to immediate US federal taxation as they arise each year. So, shares in a Captive insurance company can be attractive for US persons.

These tax efficiencies mean that holding shares of a captive insurance company is a very lucrative prospect for US persons. With many other international Investments, there is little or no tax deferral and income and profits are subject to immediate US federal taxation as they arise each year. So, shares in a Captive insurance company can be attractive for US persons.

For US investors, a captive insurance company needs to be legitimate. US case law around captives has been tough on artificial arrangements. So, an international PIF with a real international project and real operational risk is a really good Captive Insurance opportunity for US investors.

It is important to consider both the advantages and the drawbacks captive insurance company when determining whether or not it is the right strategy for your international project.

It is important to consider both the advantages and the drawbacks captive insurance company when determining whether or not it is the right strategy for your international project.

Captives, international projects, and investor protection.

The protection that a captive provides can be very attractive to an investor who might otherwise be deterred by the lack of control over a foreign or international PIF. Similarly, the ability of an owner-manager to focus on running the business without worrying about negotiating with investors over risk protection can be very appealing. Whether or not a captive is a right solution for you will depend on the specific circumstances of the PIF and the desires of the parties involved.

Ultimately, the key is to achieve the right balance of protection for investors while still allowing the owner-manager to maintain control over the business. A captive insurance company can be a helpful tool in achieving this balance.

How owner-managers use Captive Insurance to avoid conflict and maintain control

If you are an owner-manager of an oil & gas or mining project in Latin America and you are trying to raise less than US100M to grow your business. There are many potential investors in the US, but you need a well-structured international private investment fund to successfully attract accredited investors to your international project.

From the perspective of the captive insurance company, it is important to make sure that the right risks are being insured. Otherwise, the protection that the captive provides may be undermined.

Investor protection and the Captive insurance company

Investor protection and the Captive insurance company

The key to investor protection is to have a well-functioning board of directors on the Captive insurance company that can provide oversight and protection for the investors while at the same time allowing the owner-manager to have control over the day-to-day operations.

🔘 In an international Private Investment Fund, the investor is not involved in the day-to-day management. The owner-manager is managing the local operation.

🔘 The Captive insurance company can provide investors with substantial protection against loss and fraud. With an independent board of directors, the captive insurance company just needs to ensure the right range of operational risks. At the same time, given that investors have funded the Private investment fund, the owner-manager as a sponsor of the GP And PIF can spend a lot less money on legal agreements trying to balance risks for potential investors.

In summary:

Using an international private investment fund with a captive reinsurance company strategy provides investors and managers with greater clarity around their roles and associated risks. It also helps to align interests between managers and investors, as both parties have skin in the game.

Read part 1 of this newsletter on international fundraising using a captive insurance strategy here.

Leave a Reply