International Fundraising: Private Investment Funds + Boutique Caribbean Private Banks

Are you the US accredited investor or owner-manager working on establishing a Private Investment Fund, that will invest in an oil & gas or mining project in Latin America? If so, you should consider a Caribbean Private Bank as the Fund manager for your PIF.

Why use a Private bank as the Fund Manager for your international PIF?

A Private bank is subject to “prudential”, regulation. The compliance profile of a bank is therefore typically “lower compliance risk”, than a licensed fund manager, investment advisor, or regulated asset manager.

A Private bank is subject to “prudential”, regulation. The compliance profile of a bank is therefore typically “lower compliance risk”, than a licensed fund manager, investment advisor, or regulated asset manager.

Private banks are regulated by prudential regulation, which is the highest type of financial services regulation. This means that private banks are subject to regular audits and inspections. They are also required to maintain high standards of governance, risk management, and compliance. Private banks usually have a good understanding of the local laws and regulations.

US accredited investors, who are investing in a Private Investment Fund have custody of these securities and transfer funds to the PIF. In both these cases, the compliance department of the accredited investor is going to assess the “compliance risk” of the PIF. A PIF with a private bank as a fund manager will be perceived as posing less compliance risk than other fund or asset managers.

When it comes to cross-border financing. A private bank has more capabilities than other fund manager mechanisms. Other service providers like US broker-dealers, custodians, or fund administrators, who all have compliance departments and stances, will flag a GP or fund manager owned by a private bank as posing much less compliance and hence transaction risk. Some Private banks can even provide custody and fund administration services also.

A boutique private bank as fund manager of an international private investment fund

A fund manager can either be an individual or a corporate body. In the US jurisdiction, a fund manager must be registered with the US Securities Commission as an ‘Investment Adviser’. Outside the US, investment advisers are not fund managers. The fund manager has a fiduciary duty to the fund and must act in the best interests of the fund and its investors. The fund manager is responsible for the day-to-day running of the fund, making investment decisions, and ensuring that the fund complies with all relevant laws and regulations.

Most private banks will qualify as alternative investment fund managers. This is because they are subject to prudential regulation, which is the highest standard of regulation. This means that they are required to meet strict capital requirements and are supervised by a regulator on an ongoing basis. As a result, private banks are generally viewed as being low-risk.

Investors in international private investment funds can therefore be confident that their fund is being managed by a professional and regulated fund manager. Private banks are typically well-positioned to act as asset managers for private investment funds. This is because they have the necessary expertise and experience to provide professional asset management services. In addition, private banks are subject to strict regulation, which provides investors with peace of mind that their fund is being managed in a safe and responsible manner. private banks also have the advantage of being able to offer a wide range of investment products and services to their clients. This means that private banks can tailor their services to the specific needs of their clients. As a result, private banks can provide a high level of service and support to their clients. This means that private banks can provide private investment fund managers with the financing they need to grow their business. Private banks also have the advantage of being able to offer a wide range of services to their clients. Private banks also have the advantage of being able to offer a wide range of products and services to their clients.

A Caribbean private bank versus a UK, USA, or Canadian fund manager.

- If the project is less than US100M a U.S. fund manager, as in a GP, would not be registered with the SEC. If registered with the SEC, it is difficult to find US fund managers who are focusing on “small” international PIFs due to an existing gap in the market.

- Canadian asset manager – There are Canadian asset managers that focus on international oil & gas and mining projects.

- A UK fund manager is operationally too distant.

How to engage a private bank as a fund manager

This is the hardest part. There are many boutique banks in the Caribbean. Like large banks, they will usually only take on roles like this if the relationships are worthwhile. If the PIF is prepared to obtain custody and fund administration from the bank, then this is a possibility.

It may be difficult to find a Caribbean private bank to work with because most tend to be focused on wealth management and not international private equity. If you’re looking for a private bank to work with, be sure to find one that is accredited by the US. This will also work to give US investors the peace of mind that your international private equity investment is in good hands.

Should you structure your international fundraising Private Investment Fund using a Private Bank?

Fund managers can greatly benefit from structuring their fund using a private bank. By doing so, they can tap into various Double Taxation Agreements (DTAs) that exist between countries. This means that they would either be exempt from taxes on dividends and capital gains or receive a reduced rate.

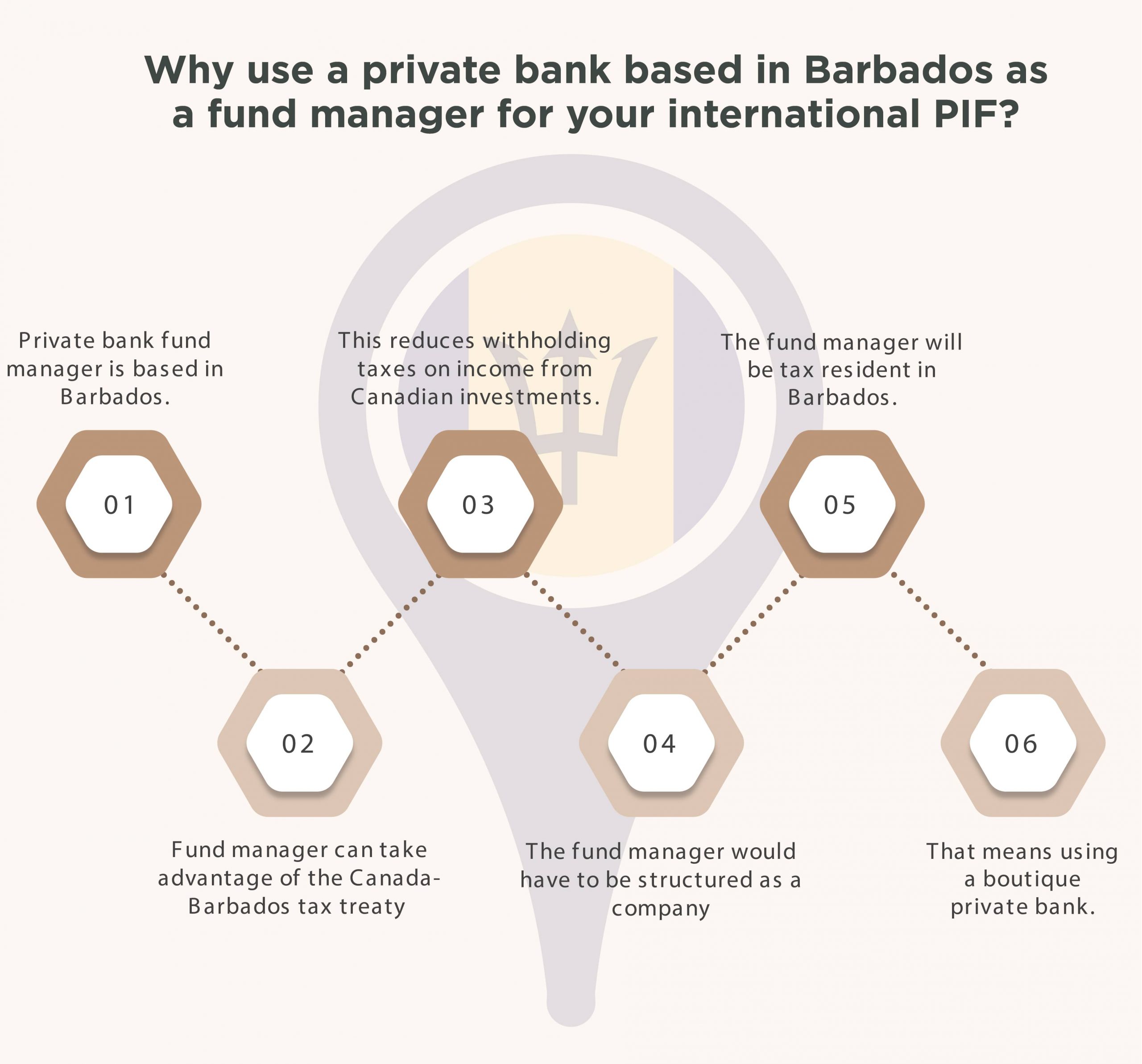

For example, if the fund manager’s private bank is based in Barbados, it could take advantage of the Canada-Barbados tax treaty and reduce withholding taxes on income flowing from Canadian investments. To do this, the fund manager would have to be structured as a company and tax resident in Barbados with its place of effective management and central management and control located there. That means using a boutique private bank.

When the fund manager is a Boutique private bank, this means that the fund will be managed in a way that meets the highest standards, and investors can be confident that their money is in safe hands.

Investors in international private investment funds should therefore consider using a private bank as their fund manager, to ensure that their money is well-protected.

Regulated GP/Fund manager

We have discussed in previous posts that international private investment funds that are international projects need regulated GPs or Fund managers. The Barbados GP can be a licensed asset manager or one of the directors could be a Caribbean Private bank. A trust could be used to own the GP and the private bank could be the trustee of that trust. The Private bank could co-manage the GP with the principals. Ideally, that Private bank would be in Barbados to ensure the GP is a tax resident in Barbados. There are many private banks in Barbados regulated by the Central Bank of Barbados, the prudential regulator.

The Barbados Private investment fund

The domestic Barbados investment fund is a bit different from investment funds in other jurisdictions except maybe Ireland. Ireland has an investment fund that is subject to Irish corporation tax. The Barbados domestic investment fund is subject to corporate income tax itself and can therefore be tax resident in Barbados. A Barbados private investment fund can have access to tax treaties including the

The domestic Barbados investment fund is a bit different from investment funds in other jurisdictions except maybe Ireland. Ireland has an investment fund that is subject to Irish corporation tax. The Barbados domestic investment fund is subject to corporate income tax itself and can therefore be tax resident in Barbados. A Barbados private investment fund can have access to tax treaties including the

U.S. and Canada tax treaties. Now, most collective investment funds utilize tax transparency. A Barbados private investment fund with treaty access offers a few different features which are more useful to owner-managers and operators.

Private bank fund managers can access the benefits of Double Taxation Agreements (DTAs) that exist between countries meaning that they would either be exempt from taxes on dividends and capital gains or receive a reduced rate. For example, if the fund is based in Barbados, it could take advantage of the Canada-Barbados tax treaty and reduce withholding taxes on income flowing from Canadian investments. To do this, the fund would have to be structured as a company and resident in Barbados with its place of effective management located there.

In summary,

The reason why some boutique banks are a good choice is that you have a better chance of being able to engage and present to management. A licensed fund manager in the same group as a private bank is also a good choice to look for.

All private banks are not the same. Some are more capable than others. Well-organized private banks that also have strong operational and working relationships like those in the US, UK, Switzerland, or Canada can offer the right service level for owner-managers.

Investing in an international private investment fund that has a private bank as the asset manager can be a great way to ensure that your money is well-managed and compliant with all regulations.

Leave a Reply