Select a Regulated Fund Manager for your International Fundraising Private Investment Fund

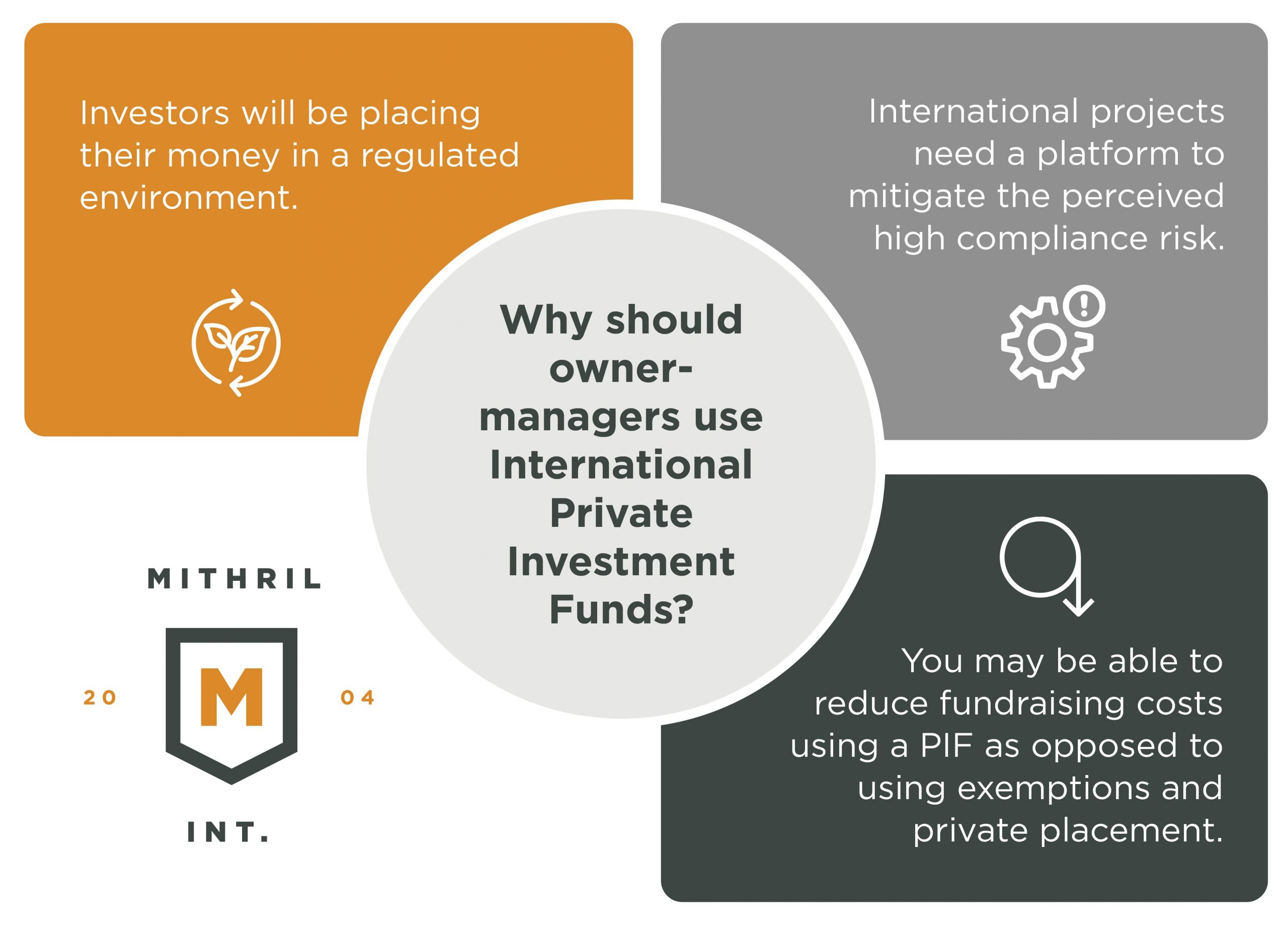

Why owner-managers should use International Private Investment Funds

The owner-operator who wants to raise less than US100M for a mining or oil & gas project in Latin America or Africa, from US accredited investors needs to take a practical approach to fundraise.

The owner-operator who wants to raise less than US100M for a mining or oil & gas project in Latin America or Africa, from US accredited investors needs to take a practical approach to fundraise.

1️. Investors are regulated and so is the money they invest in your project.

Most accredited investors have their money in custody with the US or other private banks. As an owner-operator you may be talking to accredited investors because institutions and large financial firms do not have the cost structure to spend time on “small,” yes US100M is small in some world, projects. If you want to be able to receive money from investors who have their money in regulated institutions and structures, your investment structure needs to also be regulated. Your private operational company needs to be owned by a Private Investment Fund.

Investors can then invest or buy shares in your Private Investment Fund which is also regulated.

2️. International compliance risk.

If your project is raising less than US100M, you will need a regulated private investment fund to be able to attract US investors. The reason for this is your investors have their money in private banks. Private banks have compliance departments that view anything that is not held in a regulated environment as “high compliance risk”. The perceived risk is even higher if the project is based internationally, outside the continental USA.

3️. International Private Placement OR Private Investment Fund?

A regulated fund manager is required by law to operate a regulated Private Investment Fund. Many owners think international private placements which have all the structure of private investment funds but are exempt from regulation by law are better because a regulated fund manager would not be mandatory. If you are an owner-manager doing an international fundraiser, save time and effort and arrange for a regulated fund manager even if you are running an international private placement. We think however international private investment funds are better for owner-managers.

How do owner-managers set up and operate an international private investment fund that the US accredited investors can invest in and not be blocked by their bank’s compliance department?

- Engage US securities counsel.

- Establish a regulated fund manager

- Fund – Ireland, Barbados Luxembourg

- RegD – 506(c.)

The likely outcome will be:

- Directors and shareholders can promote the investment in the US.

- Accredited investors can invest due to the low compliance risk offered by the regulated environment.

- A captive insurance strategy can be used to further reduce international risk.

Choosing a regulated fund manager

When an owner-manager sets up an LP/GP that has investors and projects in different jurisdictions, a regulated fund manager will be needed. This is necessary so that the fund is “regulated”. If the fund is regulated, accredited investors can invest in it.

There are several ways to structure an international private investment fund. But, to be able to market the fund to potential investors in the USA, the general partner or management company must be regulated by the SEC.

The most common way to do this is by having a regulated fund manager that is licensed as a fund manager or an asset manager or an alternative investment fund manager in a jurisdiction like Barbados, Ireland, or Luxembourg.

The reason for this is that these jurisdictions have laws and regulations that are similar to those in the USA. So, the SEC will recognize these regulatory regimes as being equivalent to its own.

Another way to structure an international private investment fund is to have a US-based fund management company that is registered with the SEC. This can be done by either registering as an investment adviser or as a broker-dealer. In order not to fall under an exemption, the assets of the fund would have to be more than US100M. This, therefore, is not an ideal starting point for an owner-manager with a fund management company trying to raise less than US100M.

However, this is a more complicated and expensive way to set up an international private investment fund. So, most owner-managers prefer to use the regulated fund manager route. When selecting a regulated fund manager, there are a few things that you should look for:

- The fund manager should be licensed in a jurisdiction that is recognized by the SEC.

- The fund manager should have experience managing international private investment funds.

- The fund manager should have a good understanding of US securities laws and regulations.

- The fund manager should have a good track record of performance or be able to demonstrate a good track record of operational capability and experience.

If you are an owner-manager and you are looking to set up an international private investment fund, then you should consider using a regulated fund manager. Doing so will give you access to the US market and allow you to attract accredited investors.

When selecting a regulated fund manager, make sure to look for one that is licensed in a jurisdiction that is recognized by the SEC and that has experience managing international private investment funds. Additionally, the fund manager should have a good understanding of US securities laws and regulations, as well as a good track record of performance.

Alternative investment fund managers are important because they make sure the fund is regulated. We use terminology like ‘alternative investment fund manager that is regulated in order to hopefully help you, the reader, to understand what to look for when you are trying to select a regulated fund manager for an international private investment fund.

This regulated status attracts accredited investors. When looking for a regulated Alternative investment fund manager, look for someone who is licensed in a jurisdiction that is recognized by the SEC and has experience with managing international private investment funds. Additionally, they should have a good understanding of US securities laws and regulations as well as a good track record of performance.

The fund manager should also have experience of working in the jurisdiction that the project is in and also have the willingness and ability to travel to and spend time with the project.

Selecting a regulated Fund manager for an international private investment fund

Owner-operators should look for fund managers who are focused on and used to working with closely held or owner-managed projects. These would be fund managers who do not just offer quantitative analysis but would be engaged with the commercial and operational reality of the project. This means they would be working on a mix of operational projects. They may also have a securities portfolio related to the risk management of the project.

A regulated fund manager for an international Private investment Fund should not be selected just because they have access to capital

- This might be tempting, but it poses a great risk to an owner-operator. This is because the regulated fund manager cannot understand the operational nature of the project. Therefore, there would be a great potential for miscommunication which could negatively impact the project.

- If the regulated fund manager leaves the fund at a crucial time, they may not be easily replaced. Loss of regulated status means the private investment fund would become non-compliant. Having to take just any other fund manager to retain regulated status would be fraught with risk.

- How does an owner-operator who is busy managing the operation find an alternative fund manager? Often, owner-operators want to focus on the operational aspects of their project. They don’t have time to build rapport with another fund manager who is not involved in the project. It is also important to consider which jurisdiction the regulated fund manager should come from:

☑️ London, United Kingdom

In our opinion, this is a subjective answer. The UK is good, but AIFs are geared towards larger funds. Due to the investment manager exception, funds are not tax resident in the UK. The challenge here would be finding a fund manager who is not busy and focused on managing a portfolio of hundreds of millions or billions in securities.

If you don’t have existing connections in the UK, it can take a lot of time to find the right one. The internet won’t be much help as you really need to do a deep dive on who you are going to be working with and ensure you are the right fit for each other.

☑️ BVI Approved manager.

A licensed asset manager can manage up to US400M. A BVI Asset Manager can become tax resident in another jurisdiction if the majority of directors are tax residents there. The asset manager would have to operate with the permission of those regulatory authorities. A BVI-approved manager in the US would be subject to US regulation but would likely operate under a US SEC exemption.

☑️ Irish fund manager.

Ireland is still in the EU. An Irish fund tax resident in Ireland can provide access to an excellent tax testy network. Especially if there is international financing in place.

☑️ Canadian asset manager

Canada has many asset managers that are boutique, internationally capable, and have very commercial oil & gas and mining capabilities. These investment and asset managers do a lot of institutional work but there are many small outfits that will work with “small play” owner-managed projects. Many of these asset managers are regulated by the Canadian Securities Administrators.

You should look for a Canadian asset manager that:

- is regulated by the Canadian Securities Administrators,

- has to experience with your type of project,

- and is familiar with the jurisdictions in which your project is located.

Asset managers that are regulated by the Canadian Securities Administrators will be able to market their services to US investors and offer them the protections that they are used to in the US. These asset managers will also have experience complying with US regulations, which will make it easier for you to comply with US regulations as well.

When you are looking for an asset manager, you should ask them about their experience with owner-managed projects and whether they are familiar with the jurisdictions in which your project is located. You should also ask them about their compliance with US regulations.

To find a good Canadian asset manager, look for one that:

- Is regulated by the Canadian Securities Administrators.

- Has experience with small play projects.

- Is boutique and internationally capable.

- Has commercial oil & gas and mining capabilities.

☑️ Private Bank or Merchant Bank

Owner managers increasingly need international structures and arrangements to do international business trade and investment. It is our opinion that merchant banks and boutique private banks are best for providing the services for these international arrangements.

Owner managers increasingly need international structures and arrangements to do international business trade and investment. It is our opinion that merchant banks and boutique private banks are best for providing the services for these international arrangements.

Owner managers will increasingly find that they cannot implement the best international structures and solutions with large national financial institutions. Institutions like Bank of America and Wells Fargo have all exited the non-US international private client space. For those already with these institutions, you will notice you cannot attain certain services. Large institutions will increasingly provide less non-standard arrangements to owner-managers who are doing international fundraising, business, and trade.

There are some merchant banks or boutique private banks that are small and run by a small group of people. In this case:

- The owner can deal directly with the principals.

- A private bank can undertake very tax-efficient international financing.

- A private bank in most jurisdictions is regulated by the prudential regulator. This is the highest level of regulatory standard.

- You can talk to the banks’ compliance department about what activity is and is not high risk.

- Private banks have financial services licenses that allow them to provide a range of highly customized services and solutions that would be very useful to an international private investment find. i.e Back to back loans, escrow, custody solutions.

- There is some access to the management of a private bank. If your fund is bringing enough business, there is the potential to be able to obtain highly customized services.

✅ What to look for when selecting a merchant bank or private bank:

- A merchant bank or trust company should ideally be located in an international financial center.

- The merchant bank or trust company should have experience in managing international structures and investments.

- The merchant bank or trust company should have a good reputation and be well-regulated.

- The merchant bank or trust company should offer a full range of banking services, including investment banking, wealth management, and private banking.

We believe that merchant banks and trust companies are best placed to provide the necessary services for owner-managers who need to establish international structures and arrangements. These institutions have the experience, reputation, and regulatory oversight to provide a full range of banking services in a safe and secure manner. Owner managers should therefore consider these institutions when looking for a private bank or merchant bank to partner with.

As the world of international finance gets more complex, it is important to have a partner who knows how to navigate these waters. A Private Bank is subject to prudential regulation and compliance. This should ensure that you and your investors’ money is safe and that the bank is held to a high standard of conduct.

Leave a Reply