International Fundraising – International Private Investment Funds + Fiduciary Duty Part II

The owner-manager trying to raise funds in the US for a non-US business must reduce the risk of their investment offer. Especially if they want to raise funding of US20M or more from the US and international investors. Investors are going to look at the risk of investing with you by looking at the relationship between the General Partner/ Fund manager and the investors in the fund.

Listen to the audio of this article here.

Review by Advisors of potential US investors

When looking for potential investors, transparency is key. If potential investors and their advisors cannot see the details about how their money is being invested and how it is performing, they will look for another investment opportunity. Many accredited US investors are internationally savvy. Some are not. Many US advisors are more domestically attuned. So, if you are a non-U.S. owner-manager raising capital in the USA, you must act ahead of time to mitigate the international risk associated with your project.

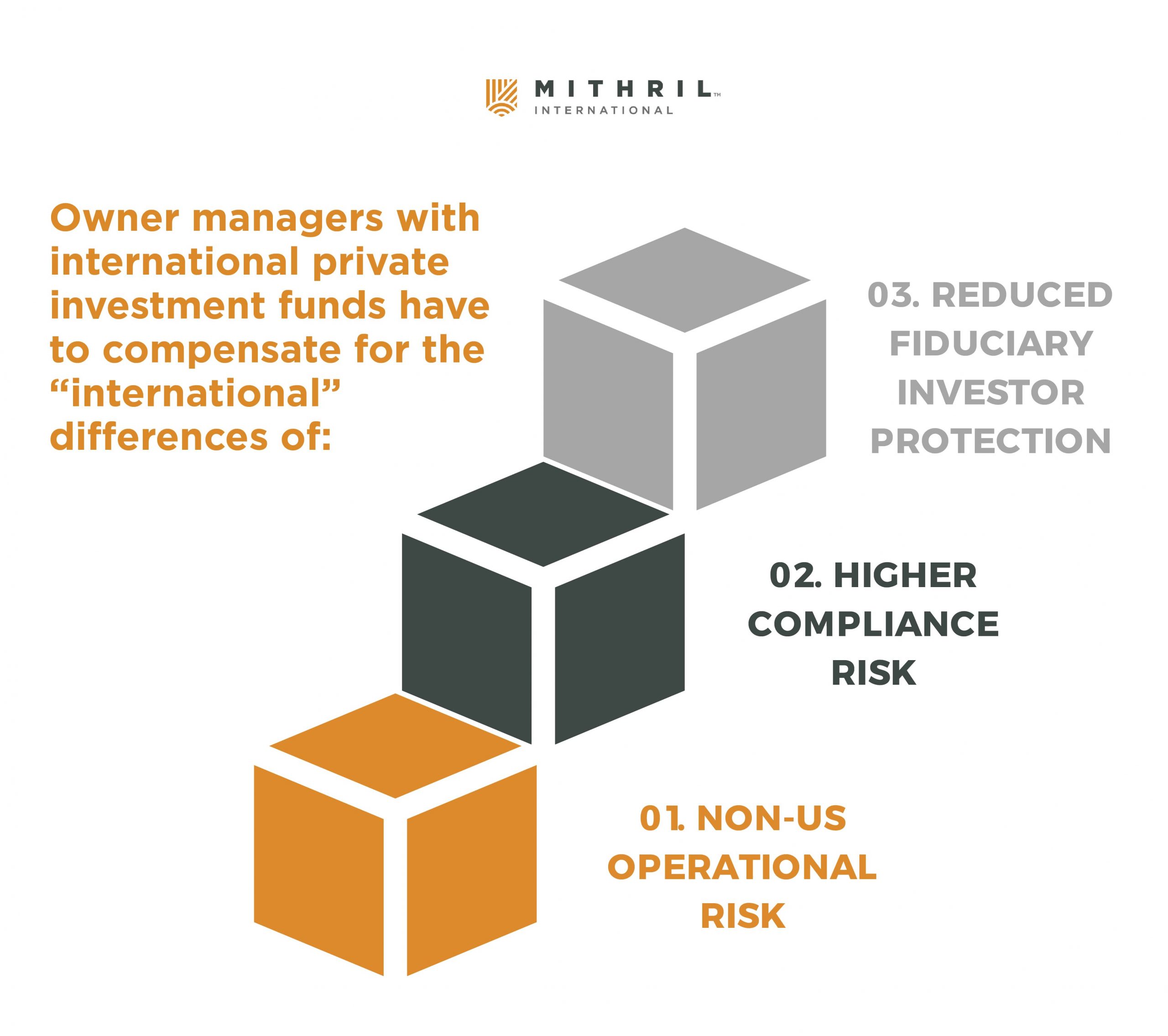

Owner managers with international private investment funds have to compensate for the “international” differences of;

Owner managers with international private investment funds have to compensate for the “international” differences of;

1️. Non-US operational risk

2️. Higher compliance risk

3️. Reduced fiduciary investor protection

You have to make clear to US investors and their advisors, how the non-domestic risks and lack of investor protection are mitigated. Two ways to do this include:

- Captive insurance

- Using a trust as the international private investment fund.

These are two approaches the international owner-manager can use to close the perception and analysis gap of US advisors.

Fiduciary duties are also generally imposed by US state law on directors of companies

Fiduciary duties are also generally imposed by US state law on directors of companies

It is usual for the fund’s investment agreement to permit the fund to indemnify the GP/ investment manager/ fund manager for any liability incurred as a result of a breach of fiduciary duty. The purpose of this indemnification is to protect the individuals who are running the day-to-day operations of the business from personal financial risk.

The key point here is that if something goes wrong with the investment fund, or if there is any mismanagement, then the people running the GP and thus the fund could not be held personally liable. This is why it is so important to have an indemnity in place.

Fiduciary duty is a mechanism applying the principles of the law of equity to a relationship between parties. An alternative to specific fiduciary duties could be to apply the principles of equity by using a trust.

Using a trust for the International Private Investment Fund

Many US private placements or private investment funds are structured as grantors or flow through trusts with banks as the investment manager and regulated custodians. This is relatively common in both the US and Canada.

When an owner-manager is trying to raise funds in the US for a non-US business, one way to reduce the risk of his investment offer is by using a trust as the international private investment fund. By doing so, the manager can create a fiduciary relationship between himself as a fund manager or trustee, and the investors, which can help establish trust and confidence in the investment fund. Using a trust can also help protect the interests of the investors by providing them with legal protections and safeguards against potential risks.

By using a trust for an international private investment fund the owner-manager is placing the law of equity and fiduciary duty at the core of the investment fund. LP/GPs offer owner managers the level of control that ultimately is needed in many operational businesses. Trusts, trustees, and beneficiaries operate similarly to the GP/LP relationship. Beneficiaries do not and cannot control trustees or the discretion they have to manage the trust.

Whether it is oil & gas, mining, infrastructure, or farming, an owner-manager tasked with managing an operation to success is considerably more focused on the level of control he or she maintains in crisis, difficult times, or when it becomes difficult to communicate with investors.

The owner-manager has to be confident that he is acting in the best interests of the fund at all times. The trust deed and related documents govern the relationship between the fund and the trustee. Due to its legal nature, a trust will act to prevent the trustees who may be the owner or who appoint the owner-manager to manage, from engaging in acts that are a conflict of interest.

The owner-manager has to be confident that he is acting in the best interests of the fund at all times. The trust deed and related documents govern the relationship between the fund and the trustee. Due to its legal nature, a trust will act to prevent the trustees who may be the owner or who appoint the owner-manager to manage, from engaging in acts that are a conflict of interest.

By using a trust as the international private investment fund the owner-manager is sending a clear signal to US advisors that fiduciary investor protection is at the core of the arrangements. By using a trust, by its very nature, it is not possible to restrict fiduciary duty or the wider law of equity. Distinct indemnities can be drafted for the trustees, but these will be relatively specific in nature and application.

Captive Insurance – Addressing the investor protection gap

By ensuring that your international private investment fund has a strong relationship with a captive insurer you can help to mitigate some of the risks associated with investing in a non-U.S. business. This can go a long way to instilling faith and trust in your international private investment fund, and ultimately help to attract more investment into your business.

In previous writing on this topic, we have outlined the role of captive insurance in the mitigation of international risk. We also discussed how a captive can provide a number of advantages to the business owner including cash flow, risk management, and tax efficiency. But there is another layer to the role of captive insurance, and that is protection for the investor.

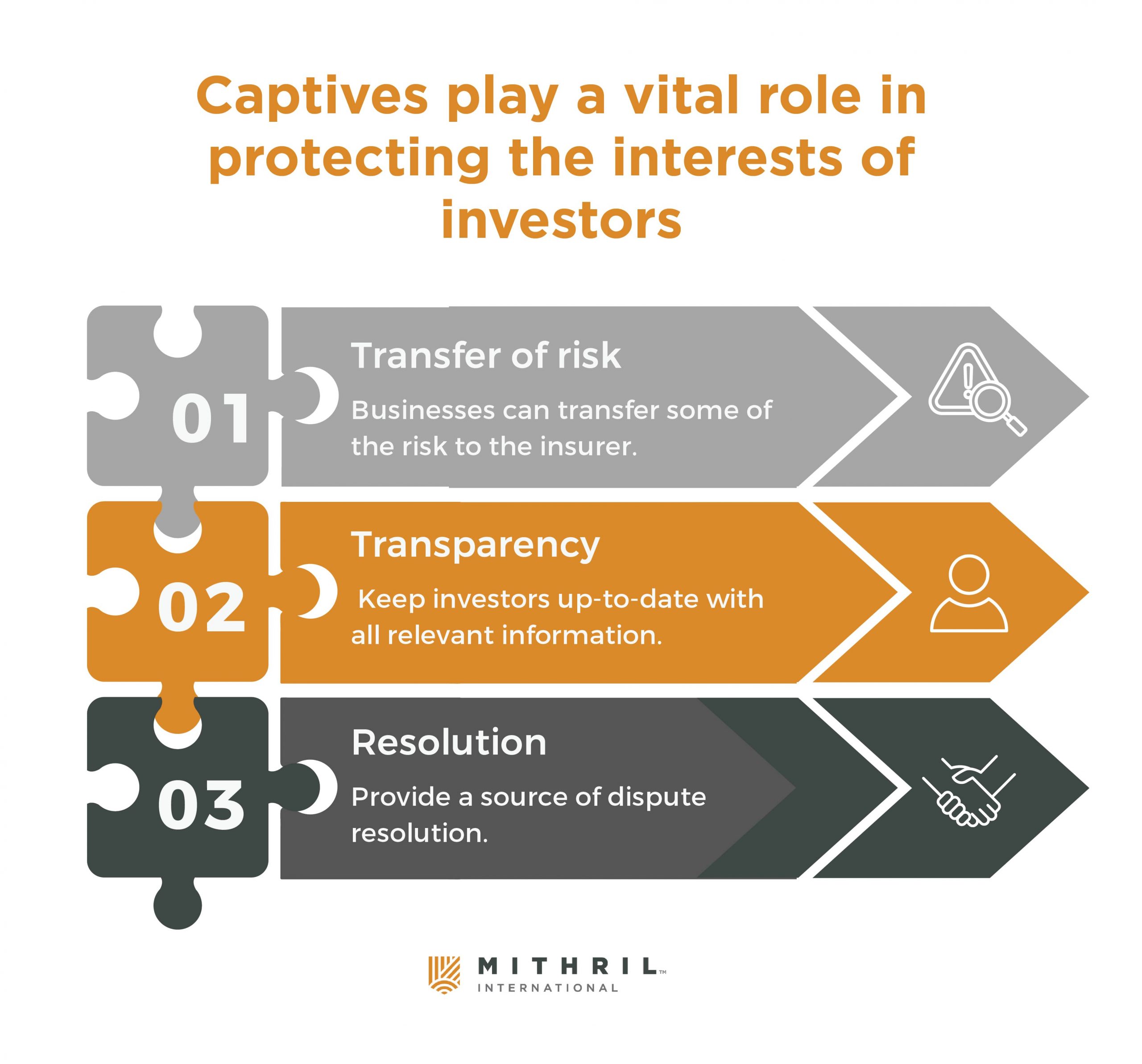

When it comes to mitigating risk, a captive insurer can play an important role in protecting the interests of investors by acting as a buffer between them and the underlying risks of the business. In essence, a captive can help to reduce the investment risk for investors by providing them with a source of reimbursement in the event that something goes wrong.

There are a number of ways in which a captive can provide this level of protection, but one of the most important is through the use of loss mitigation strategies. By utilizing a captive insurer, businesses can effectively transfer some of the risks to the insurer in exchange for a higher premium. This allows businesses to protect their investors from the full brunt of any potential losses and provides them with a safety net in the event that something does go wrong.

Another key way in which a captive can help to protect investors is by acting as a conduit for information. By utilizing a captive, businesses can ensure that their investors are kept up-to-date with all relevant information relating to the business and its activities. This includes providing regular updates on the financial performance of the business, as well as any material changes that may have an impact on the investor’s interests.

Captive insurance and international dispute resolution

In addition, captives can also help to protect investors by acting as a source of dispute resolution. The owner-manager can place a greater number of independent directors on the board of the Captive insurance company. This does not restrict his control of the operating company. In the event that an investor feels that they have been wronged by the business, they can utilize the captive insurer to help resolve the matter. This can often be done without the need for costly and time-consuming legal action, which can further protect the interests of investors.

It is clear that captives can play a vital role in protecting the interests of investors. By utilizing a captive insurer, businesses can transfer some of the risks to the insurer, keep investors up-to-date with all relevant information and provide a source of dispute resolution. This can all help to reduce the investment risk for investors and give them peace of mind knowing that their interests are being protected.

It is clear that captives can play a vital role in protecting the interests of investors. By utilizing a captive insurer, businesses can transfer some of the risks to the insurer, keep investors up-to-date with all relevant information and provide a source of dispute resolution. This can all help to reduce the investment risk for investors and give them peace of mind knowing that their interests are being protected.

US advisors will quickly differentiate a U.S. domestic proposition from a non-U.S. proposition.

If economic returns are comparative then it will be very easy for advisors to separate out your proposition. Many family offices or GP investment executives whose job it is to scour initial offerings will tell you that no one ever got fired for recommending investing in Coca-Cola. Exotic risky international investments, therefore, have a hard time with US investors.

The funds and financing based in a tax-neutral jurisdiction are fully subject to the Fiduciary duty between the fund and the investment manager. Once a Captive Insurance company is based in a tax-neutral jurisdiction, with every premium payment the risk of an international project decreases, and investor protection increases.

The Captive Insurance company and owner manager’s fiduciary duty to the fund

There are two options when it comes to using a Captive Insurance company to mitigate international risk and increase investor protection. The captive insurance company can be;

There are two options when it comes to using a Captive Insurance company to mitigate international risk and increase investor protection. The captive insurance company can be;

- owned by the private investment fund.

- owned directly by Strategic investors and the fund.

If the Captive insurance company is owned by the Private Investment Fund, the conduct in relation to the Captive is subject to fiduciary duty provisions in the investment agreement between the fund and the GP/ investment manager/ fund manager. Analysis of the Captive Insurance company fiduciary duty is essential to protect the interests of the fund and its investors as this Fiduciary duty will:

- Ensure that the company’s assets are used for the benefit of the policyholders and not for the personal gain of the directors or shareholders.

- Help to avoid any potential conflict of interest between the Captive Insurance company and the investment fund.

Why use Caribbean Captive insurance companies?

The owner-manager could domicile the Captive Insurance company in the country in which the business is located. However, a second option is to domicile it in a more tax-neutral location in the Caribbean.

The key distinction between these two options is that, in the case of domiciling the Captive Insurance company in the country of the business, the owner-manager will be operating under local laws and regulations.

This would mean investor protections are not afforded like they are in other jurisdictions. However, it is important to note that these protections may not be available to all investors, depending on their citizenship or residency status.

For example, if an owner-manager were to domicile their Captive Insurance company in Argentina, they would be subject to the Argentine law. This would include the Fiduciary Duty of Trustees, which is enshrined in Argentine law. This duty requires the owner-manager to act in good faith and in the best interests of the fund and its investors.

The key advantage of domiciling the Captive Insurance company in a more neutral jurisdiction, in the Caribbean, is that it offers greater flexibility when it comes to compliance with local laws and regulations. This can be a significant advantage for owner-managers who are seeking to raise funding from international investors.

It should be noted that, while the Caribbean jurisdictions do not have a Fiduciary Duty of Trustees like Argentina, they do have a common law or equity and equitable principles that can act in a wider range of circumstances to protect investors from fraud and other forms of financial misconduct and also unfairness. The law of equity provides a high level of investor protection and can be used to hold owner managers accountable for their actions.

In summary, the decision of whether to domicile the Captive Insurance company in the country of the business or in a more tax-neutral common law jurisdiction will ultimately depend on the owner manager’s specific circumstances. However, it is important to consider all of the implications before making a decision.

Read Part I of this article here.

Leave a Reply