Could a captive insurance company be an international fundraising solution for your international project?

If you are thinking of international fundraising for your international private investment fund, consider the advantages that a Captive reinsurance company can offer. A Captive can help to reduce risk and increase control, making your fund more attractive to potential investors. With the right Captive in place, you can be well on your way to achieving your fundraising goals.

Overall, using a Captive reinsurance company can offer a number of advantages to international private investment funds. If you are an owner-manager and are considering using a Captive reinsurance company to attract potential investors, to your international project there are some key benefits that you can expect.

By using a Captive:

- You can offer potential investors more protection.

- Reduce some of the risks associated with operating an international private investment fund. This can be a valuable selling point when fundraising, as it can give your fund a competitive edge.

- A Captive can also help to increase the control that the owner-manager has over the fund.

- By reinsuring through a Captive, the owner-manager can retain more control over claims handling and policy terms and conditions. This can give you greater flexibility in how you run your fund, and allow you to tailor policies to better meet the needs of your investors.

- By reducing risk and increasing control, captives can make your fund more attractive to potential investors and help you to raise the capital you need to grow your business.

- A Captive insurance company can be used to insure against a variety of risks, including investment risks. This can help to reduce the overall risk profile of the fund and make it more attractive to potential investors.

- One of the key benefits of using a Captive insurance company is that it can help to protect against fundraising risks. For example, if an investor withdraws from the fund, the Captive can help to cover any resulting losses. This can give investors greater confidence in the fund, and make it more likely that they will commit to investing.

- Another benefit of using a Captive is that it can help to provide greater control for the owner-manager. For example, the Captive can be used to manage investment risks, such as currency fluctuations or political instability. This can give the owner-manager more certainty over the performance of the fund and make it easier to achieve

Using a Captive reinsurance company can provide many benefits for international private investment funds. By reducing risk and increasing control, Captives can make your fund more attractive to potential investors and help you to achieve your fundraising goals.

How can Captive Reinsurance benefits owner-managers who manage PIFs?

If the owner-manager decides to use a Private investment Fund and includes a Captive insurance company in the Offer memorandum/ Investment prospectus, a number of strategic benefits will be apparent, that will increase the chances of raising capital using the Private Investment Fund and give the owner-manager more control:

The Captive reinsurance company will reinsure the business risk of the local operating company (“LOC”) in Latin America. Especially for commercial risks for which no cover is available in the local country:

The Captive reinsurance company will reinsure the business risk of the local operating company (“LOC”) in Latin America. Especially for commercial risks for which no cover is available in the local country:

- Tangible investor protection.

The shares of the Captive insurance company can be issued to some strategic investors of the PIF. If there was a fraud event the Captive would pay out and the investors would be covered.

- Reduced international risk.

The Captive insurance company is insuring real economic and operational risks of the LOC. As Captive increases its financial balance sheet it becomes stronger and the investors who are shareholders benefit. The international risk of the project is reduced as the captive insurance company and the project generates more Cashflow.

- Less need for independent directors.

The Captive reinsurance company can insure the local operating company against risks like business loss, key man insurance, and fraud loss. If there is an independent board in the captive reinsurance company, investors will be more confident that there will be a payout in an event caused by the fund manager/owner operator. The owner-manager can thus make the case that there is less need for independent directors on the border of the GP.

- Investment agreement between fund and GP.

Normally fund managers include clauses that create exclusions of fiduciary and other duties. This is an attempt by fund managers to reduce the potential for litigation liability and maintain control of the fund. If a Captive insurance company is in place and committed to in the Offer Memorandum, investors may be less concerned with legal exclusion or restricting provisions in the investment agreement. Certainly with insurance in place, investors may be less likely to initiate litigation if there is an event.

- Enhanced financial incentives for US investors.

I am advocating that a plan for a Captive insurance company is included in the Offer memorandum for the Private Investment Fund so that investors know it is a legal commitment of the fund managers. For US investors, the Captive insurance company is very tax efficient including:

- Up to US 2.2M of underwriting, premium income is exempt from gross income. (US risk only)

- Loss reserve deductions.

- Deferral of taxation of investment income.

- Dividends received deductions.

These tax efficiencies mean that holding shares of a captive insurance company is a very lucrative prospect for US persons. With many other international investments, there is little or no tax deferral and income and profits are subject to immediate US federal taxation as they arise each year. So shares in a Captive insurance company can be attractive for US persons.

For US investors, a captive insurance company needs to be legitimate. US case law around captives has been tough on artificial arrangements. So an international PIF with a real international project and real operational risk is a really good Captive Insurance opportunity for US investors.

- Captive insurance is highly regulated.

A captive insurance company is a highly regulated arrangement. There is a substantial amount of reporting, both regulatory and financial. Investors will be able to get access to this regulatory and financial reporting on the economic risk that has been insured. This is exactly the type of information that will inform investors of risk, exposure, and cost of capital around the international project. The focus for this type of information will be satisfied by the captive insurance structure, not the PIF.

Captive insurance companies can provide many benefits for international private investment funds

Some of these advantages include:

- Increased chances of fundraising and

- More control for the owner-manager.

- Captives can also help to reduce overall costs and risk exposure.

- Captives can offer lower investment minimums than traditional investment vehicles. This can make them more attractive to potential investors. This can make the fundraising process simpler and less time-consuming

- Captives also offer more control to the owner-manager.

- For instance, Captives allow the owner-manager to customize the investment strategy and structure. This flexibility can be helpful in achieving specific goals. In addition, Captives are not subject to the same reporting and disclosure requirements as other types of investment vehicles. This can give the owner-manager more latitude in terms of how information is shared with investors.

- Captives can also help to reduce overall costs and risk exposure.

- For instance, Captives can provide tax advantages in some jurisdictions. In addition, Captives often have lower overhead costs than other types of investment vehicles. This can help to keep more of the fund’s assets invested, rather than being used to cover expenses.

- Captives also offer flexibility in terms of investment strategies and structuring.

For instance, Captives can be used to invest in a variety of asset classes. This can provide diversification benefits for the fund. In addition, Captives can be structured in a way that aligns with the specific goals of the fund.

All of these factors make Captive insurance companies an attractive option for international private investment funds. When considering a Captive, it is important to work with an experienced advisor to ensure that the Captive is properly structured and that all of the potential benefits are realized.

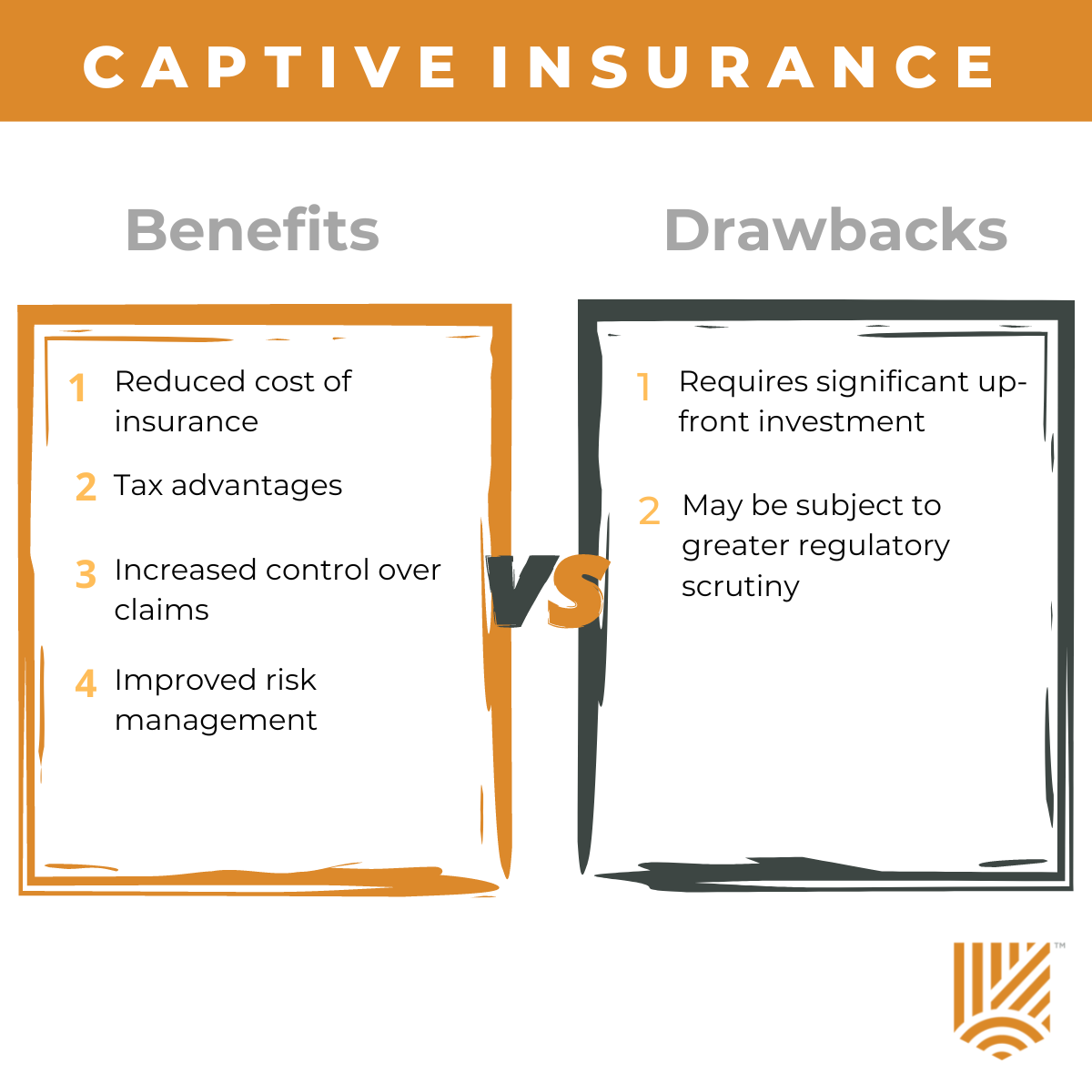

While using a Captive reinsurance company has a number of advantages, it is important to consider the potential disadvantages before making a decision.

Some of the potential disadvantages of using a Captive include;

Some of the potential disadvantages of using a Captive include;

- The needs to post collateral,

- the potential for adverse selection, and

- the possibility of regulatory changes.

Overall, the use of a captive insurance company can provide significant advantages for international private investment funds. These advantages can help to:

- increase the chances of fundraising and

- give the owner-manager more control.

- In particular, using a Captive can help reduce risk.

This can make the fund more attractive to investors and help the owner-manager to achieve their fundraising goals. These factors can be critical in ensuring the success of an international private investment fund.

Before making a decision about whether or not to use a Captive, it is important to carefully consider the pros and cons. The advantages of using a Captive can be significant, but there are also some potential disadvantages that should be considered.

Ultimately, the decision about whether or not to use a Captive insurance company will come down to a balancing of the advantages and disadvantages. For many international private investment funds, the advantages of using a Captive will outweigh the potential disadvantages. However, it is important to carefully consider all of the factors before making a decision. The use of a captive insurance company can provide significant advantages for international private investment funds. These advantages can help to increase the chances of fundraising and give the owner-manager more control.

Leave a Reply