Determining the Tax Residence of a Fund

The tax residence of a fund manager is a key factor in determining the tax residence of a fund. In many cases, the fund manager will be located in the same country as the fund itself. However, there may be instances where the fund manager is based in a different country.

The tax residence of an investment fund depends on the tax residence of the fund manager. If the fund manager is based in a country with a favorable tax regime, this can result in significant tax savings for the fund. However, if the fund manager is based in a country with a less favorable tax regime, this can increase the taxes that are payable on the fund’s income.

If the fund manager is based in a different country to the fund, it is important to consider the tax implications of this arrangement. In some cases, it may be beneficial to have the fund manager located in a country with more favorable tax laws. However, this must be balanced against any potential compliance issues that may arise.

Fund managers can use double tax treaties to reduce taxation costs and increase the profits earned by the fund

One way to reduce the amount of tax that is due is to use the provisions of a double tax treaty. This can be useful if the fund manager is based in one country but the fund itself is located in another. By using the treaty, it may be possible to reduce or eliminate altogether the withholding taxes that would otherwise be payable.

One way to reduce the amount of tax that is due is to use the provisions of a double tax treaty. This can be useful if the fund manager is based in one country but the fund itself is located in another. By using the treaty, it may be possible to reduce or eliminate altogether the withholding taxes that would otherwise be payable.

It is also worth noting that the tax residence of a fund can change over time. This may happen if the fund moves to a new country or if the fund manager changes location. As such, it is important to keep track of the tax residence of a fund on an ongoing basis.

The tax residence of an investment fund can have a significant impact on the taxes that are payable on the fund’s income. It is therefore important to carefully consider the tax implications of any proposed fund structure before making any decisions.

The international taxation of fund managers can be a complex area, as the tax residence of the fund manager may not always be the same as the country in which the fund is located. This can lead to difficulties in determining which taxes are due and how much should be paid.

One way to reduce the complexity of international taxation for fund managers is to make use of double tax treaties. These treaties can provide relief from withholding taxes on income received from another country, making it easier for fund managers to comply with their tax obligations.

While the international taxation of fund managers can be complex, it is important to ensure that all taxes are paid in order to avoid penalties. By making use of double tax treaties, fund managers can reduce their tax burden and ensure that they are in compliance with the law.

Typical fund structures that do not have access to treaty benefits and thus incur higher international taxation

US LLC fund manager and Cayman fund

If the fund manager is a tax resident of the U.S., the fund could be structured as a Cayman Islands Exempted Limited Partnership. The partnership would be managed by a U.S. LLC which would be tax transparent for U.S. federal income tax purposes. This structure would allow the fund to take advantage of the “check-the-box” rules and choose to be treated as a partnership for U.S. federal income tax purposes. The partnership would not be subject to U.S. taxation on its offshore earnings and gains unless it elected to “check the box” and be treated as a corporation for U.S. federal income tax purposes.

UK Fund manager and Jersey LP

If the fund manager is a tax resident of the U.K., the fund could be structured as a Jersey Private Fund Limited Partnership. The partnership would be managed by a U.K. LLP which would be transparent for U.K. income tax and capital gains tax purposes. This structure would allow the fund to take advantage of the “look-through” rules and choose to be treated as a partnership for U.K. taxation purposes. The partnership would not be subject to U.K. taxation on its offshore earnings and gains unless it elected to “look-through” and be treated as a corporation for U.K. taxation purposes.

UK Fund manager and Cayman LP

If the fund manager is a tax resident of the U.K., the fund could be structured as a Cayman Island Exempted Limited Partnership. The partnership would be managed by a U.K. LLP which would be transparent for U.K. tax purposes. This structure would allow the fund to take advantage of the “check-the-box” rules and choose to be treated as a partnership for U.K. income tax purposes. The partnership would not be subject to U.K taxation on its offshore earnings and gains unless it elected to “check the box” and be treated as a corporation for U.K income tax purposes.

The international taxation of private investment funds can be complex, depending on the tax residence of the fund manager. However, if the fund manager is aware of the provisions of double tax treaties, there may be opportunities for reducing withholding taxes.

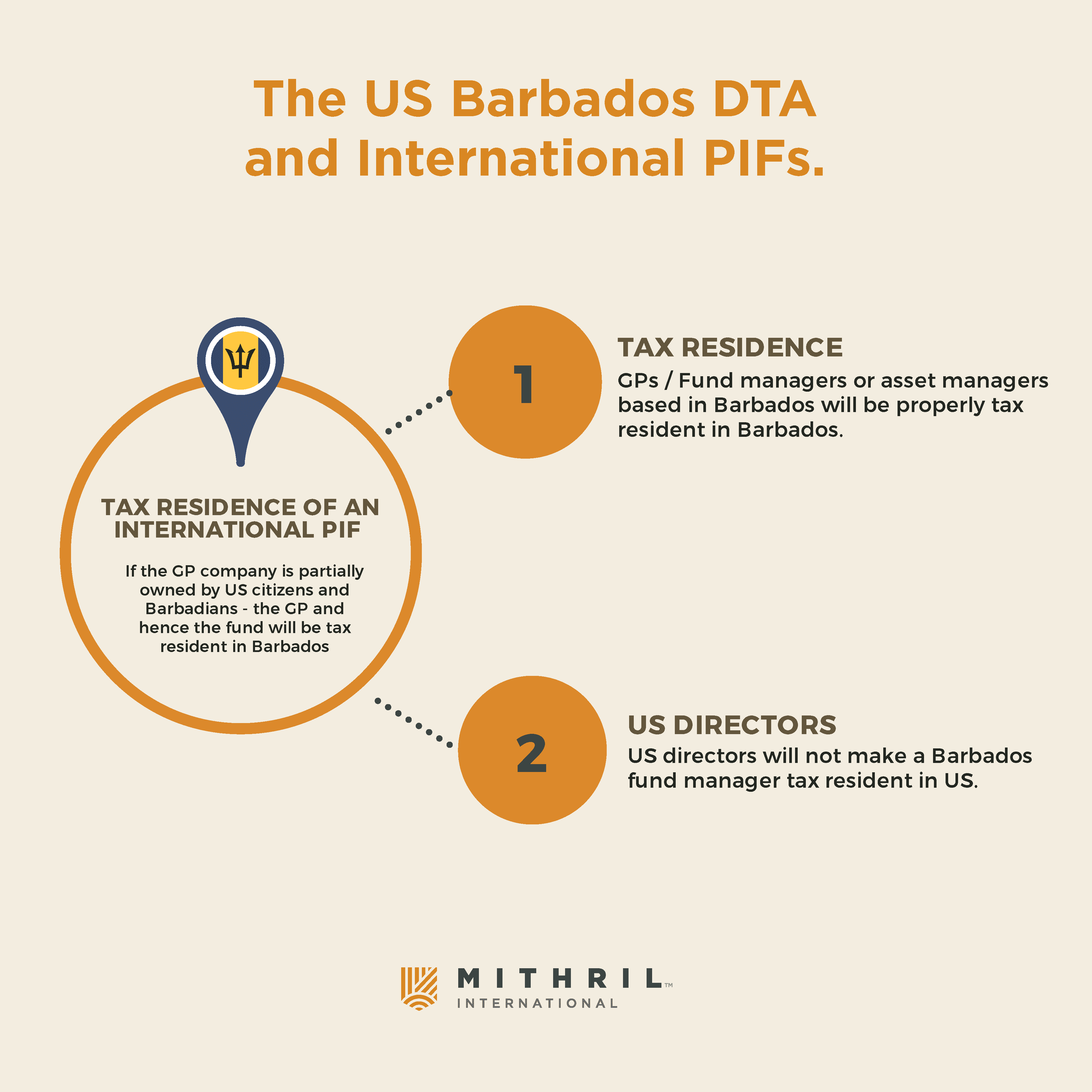

The US Barbados DTA and International PIFs

Tax residence of international PIF

Tax residence of international PIF

GPs / Fund managers or asset managers based in Barbados will be properly tax residents in Barbados. If the GP company is partially owned by US citizens and Barbadians – the GP and hence the fund will be tax resident in Barbados.

US directors will not make a Barbados fund manager tax resident in the US

The addition of US directors to the GP board will change the operational and compliance risk profile for US investors, banks, custodians, and other US service providers. Accredited investors and US service providers will all view the international private investment fund with a different lens of the IPIF have a U.S. office and presence. US directors can be added without making the PIF tax resident in the USA.

Ensuring the fund manager is a tax resident outside the US

The US Barbados DTA has articles and provisions that enable the tax residence of the international PIF to be maintained in Barbados even though it has an office, some directors, and investment operations in the US. Some of my US colleagues will note that there could be a treaty override in the US if in fact the ECI activity thresholds are exceeded. Some treaties are of limited value or offer limited protection. It is our opinion the double tax treaty adds substantial value and certainty in the context of US operational activity.

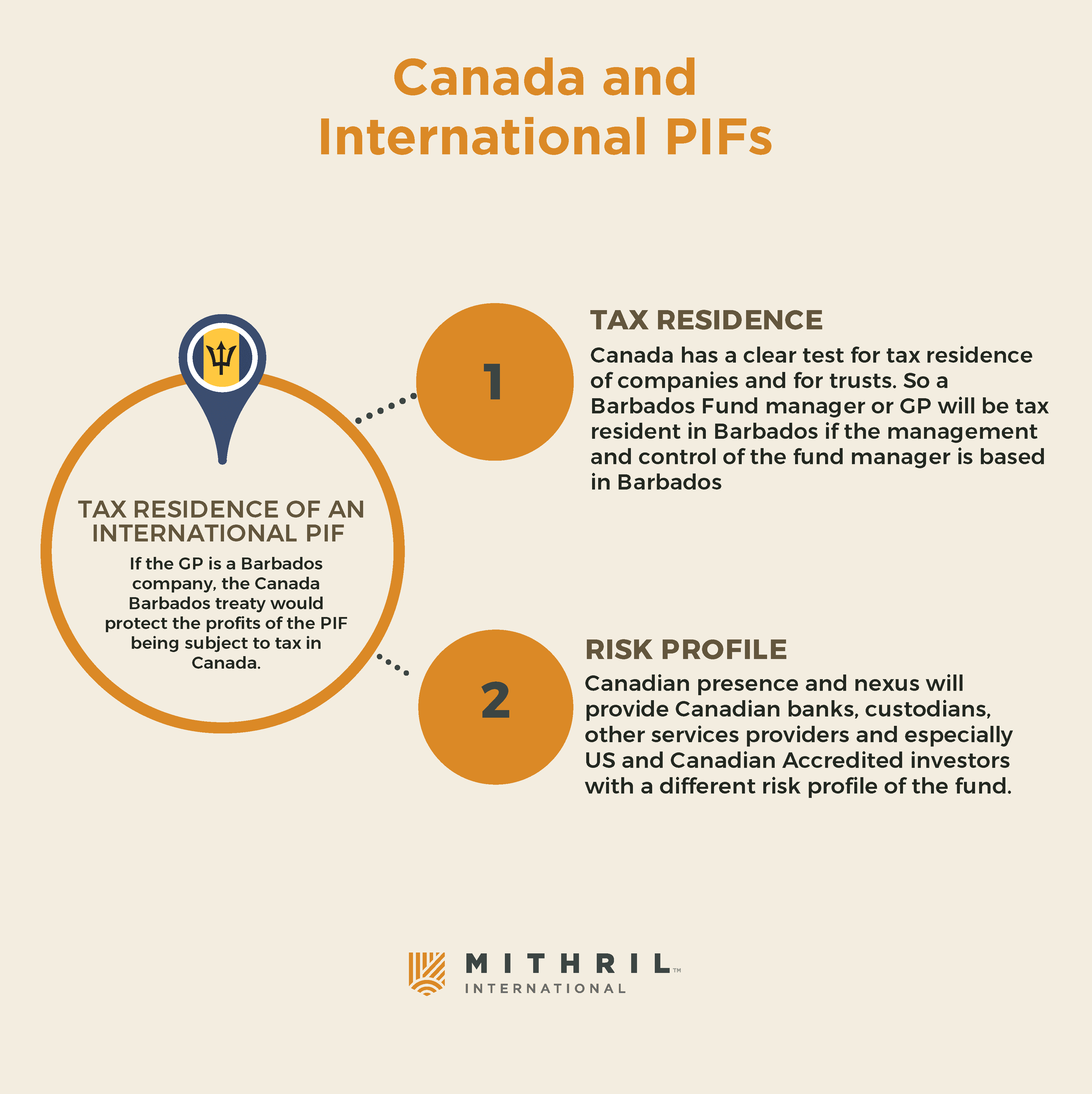

Canada and an International PIF

Similar to the US, an international PIF with investment operations, offices, banking, and directors in Canada will have a substantial presence in Canada. This Canadian presence and nexus will provide Canadian banks, custodians, other service providers, and especially US and Canadian Accredited investors with a different risk profile of the fund. If the GP is a Barbados company, the Canada Barbados treaty would protect the profits of the PIF from being subject to tax in Canada.

Similar to the US, an international PIF with investment operations, offices, banking, and directors in Canada will have a substantial presence in Canada. This Canadian presence and nexus will provide Canadian banks, custodians, other service providers, and especially US and Canadian Accredited investors with a different risk profile of the fund. If the GP is a Barbados company, the Canada Barbados treaty would protect the profits of the PIF from being subject to tax in Canada.

The test for Canadian tax residence

Canada has a clear test for tax residence of companies and for trusts. So a Barbados Fund manager or GP will be a tax resident in Barbados if the management and control of the fund manager are based in Barbados. For a start, if the majority of the Board directors are based in Barbados, tax residence, all other things being equal, is in Barbados.

Canadian banks and international PIFs

Canadian banks are more international than banks in the US. Canadian banks currently have operations in the Caribbean and still some in Latin America. Some Canadian banks remain in Latin America like Scotia bank. Canadian banks have much more experience when it comes to international projects. Oil & gas companies and mining companies will be able to find an extensive range of Canadian service providers including fund administrators and custodians that are used to working with international projects.

Canadian corporate presence

The international Private Investment Fund may also want to establish a Canadian administration and marketing company. Canada does have double taxation treaties with all Latin American nations. A Canadian-based company could serve a number of functions including enabling the debt financing of the Latin American Local operating company.

The tax consequences to the fund and the fund manager of this choice would be that any distributions from the Latin American company to the Canadian company would not be subject to local withholding taxes in most cases if certain requirements are met. The interest payments on the debt incurred by the Canadian company to finance its share of the Latin American business would also be largely protected from withholding taxes. The fund may also choose to have its Latin America investments managed by a foreign-based affiliate. In this case, it is important to consider how the income from these investments will be taxed in the country where they are generated as well as in Canada.

If the fund manager is based in Canada, the fund’s income will be subject to Canadian taxation. If the fund manager is based in a country with which Canada has a tax treaty, there may be some relief from double taxation.

If there is a foreign-based fund manager, there can be significant tax advantages to setting up a Canadian subsidiary or marketing company. With a properly structured Canadian subsidiary, you can minimize withholding taxes on interest payments and distributions from Latin American investments. You can also take advantage of Canada’s double taxation treaties with all Latin American nations.

International PIF and The Canada Barbados DTA

If the international PIF is getting investment operations services from Canadian service providers and it has a Canadian company and some of the directors of the fund manager are based in Canada, the Barbados Canada DTA – will provide some certainty when it comes to ensuring the tax residence of the PIF is outside of Canada.

Using a Canadian Limited Partnership for the PIF

There are many ways to establish international Private Investment Funds. The sponsors could use a Canadian Limited Partnership and a Canadian GP company. An entirely Canadian structure – including the Canadian GP could be made tax resident in Barbados. The international PIF and the fund manager – would then be non-domiciled people in Barbados. A non-domiciled person has limited or no access to treaty benefits but would not be subject to tax on profits made outside of Barbados.

International PIF – Canadian LP and Barbados GP

If the GP or Barbados fund manager is a Barbados company, that company will be tax resident in Barbados. The Canada Barbados tax treaty will apply to the activity and profits of the GP company/ Fund manager. The international PIF as a whole if there is a Barbados GP of the Canadian LP – will be a non-domiciled person in Barbados and will be exempt from taxation on non-Barbados source income.

We only need the GP/fund management company to have access to the Canada Barbados tax treaty. The Barbados company can establish an unlimited liability company in Canada to enter into service agreements with Canadian service providers. A tax base will not be established in Barbados.

Leave a Reply