The EU Money Laundering Blacklist : A Case of Barbados.

Over the last five decades, Financial Intelligence Units across the globe have worked with governments globally to develop robust anti money laundering (AML) and combating the financing of terrorism (CFT) policies and legislation.

On May 5th 2020, the European Union expanded their money laundering blacklist to unfortunately include Barbados from October 2020, amongst 12 other jurisdictions that they deem as high risk. The blacklist mentioned five particular areas for Barbados to improve on, these range from; a lack of risk-based supervision for businesses that are likely to be used for money laundering to knowing the complete ownership of the companies based there.

This ill-advised decision is an injustice to the Barbadian AML legislative framework and deeply contrasts with the national AML/CFT reforms that Barbados have been developing over the last two years. According to the FATF, (the global money laundering and terrorist financing inter-governmental body that set the standards and regulations that aim to prevent illegal activities). “Barbados completed its mutual evaluation report (MER) in November 2017 and since then has made progress on a number of its MER recommended actions to improve technical compliance and effectiveness”. The legislative amendments to Barbados’ AML/CFT regime have defended Barbados to a certain extent as the Financial Action Task Force (FATF) agreed that Barbados would be placed on a monitoring list. It must be noted that the FATF have not placed Barbados on the money laundering blacklist, the European Commission, whom are one of the founders of the FATF have decided to blacklist Barbados so there seems to be a level of disparity between these two global standard setters.

A new era of transparency is upon us and has become increasingly important as the world transitions into a new time of compliance and conducting business.

Jurisdictions such as Barbados have been and will continue to work towards taking the necessary measures that prevent the misuse of legal persons or arrangements for money laundering or terrorist financing. It’s crucial that both the local authorities and clients know that a service provider or business owner is fully compliant and transparent in terms of service delivery and operations. This builds trust between the client and service provider and also demonstrates compliance to the relevant authorities.

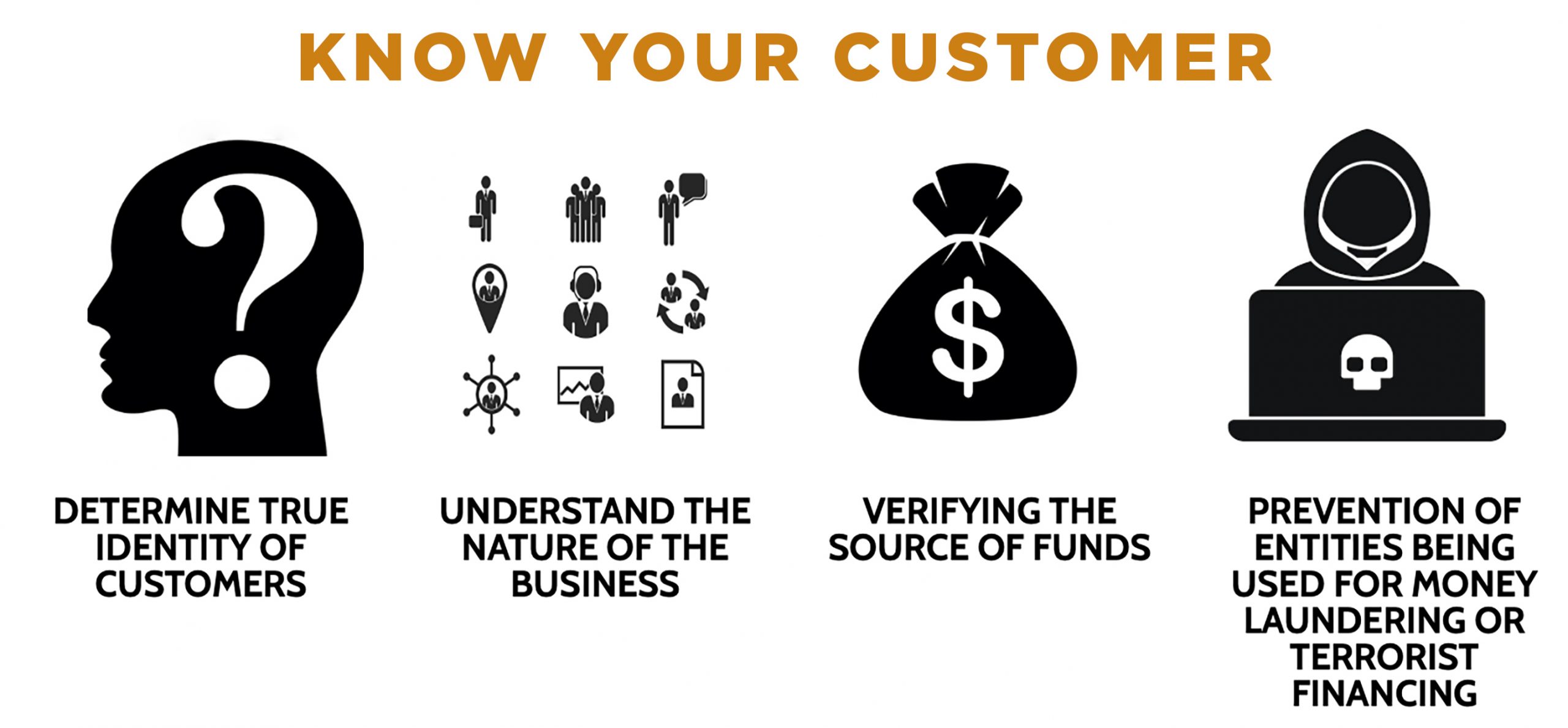

Barbados, along with more than 200 countries across the globe are in the midst of combatting the global COVID-19 pandemic. Some argue that the blacklisting of the 22 jurisdictions could not have come at a worse time. Economies around the world are enduring the severe impact of the COVID-19 pandemic and many are implementing recovery strategies and working towards reopening their countries. The negative connotations that being blacklisted conveys could discourage investors and clients from choosing Barbados as the jurisdiction from which their international business and wealth management platform is established because of concerns with the integrity of Barbados’ banking and financial services industry. It is crucial that banks and service providers reassure clients and investors that they operate and function within a framework of high legal, professional and ethical standards. A reputation for integrity and transparency, knowing your customer and your customer’s customer is the one of the most valuable assets of a financial institution and should always be showcased when interacting with clients and investors.

Barbados’ financial services industry will be affected by the current global pandemic in numerous ways. The main issue being “picking up the economic slack” due to the decline in tourism as a result of COVID-19. Organized criminal groups are continuously looking for new ways and schemes for laundering their funds. Economies with growing or developing financial centers are targeted jurisdictions for ML and terrorist financing. It is therefore imperative that these jurisdictions implement adequate AML controls and comprehensive regimes. The increase in responsibility in the financial services industry means that maintaining full compliance as it relates to AML policies and procedures is more important now than it ever has been.

Another aspect of the financial services sector that is impacted by the ML blacklist decision is the Correspondent Banking Relationships (CBRs) between financial entities. CBRs are essentially arrangements or agreements for the provision of banking services – mainly payments, cash management and trade services –provided by one financial entity to another foreign financial entity. CBRs are an integral component of an efficient international financial system and the loss of CBRs can effect economies through reduced international trade and investment.

In recent years, financial entities have become more sensitized and cautious as it relates to the risks of CBRs and as a result of this, many CBRs have been withdrawn. The nature and structure of CBRs make these arrangements more susceptible to money laundering activities as part of the CBR enable banks to undertake transactions where no physical presence of the client is required. Banks are becoming increasingly suspicious of jurisdictions which are deemed as susceptible to money laundering and terrorist financing and as a result, many jurisdictions around the world have seen a decline in the CBRs with banks in the USA and Canada due to the increased ML/TF risks. It is imperative the respondent banks perform the necessary customer due diligence, fulfill the obligatory compliance requirements and monitor account activities of customers before engaging with the correspondent bank.

Banks that are licensed in Barbados only have access to Barbados dollars. In order to gain access to US dollar bank accounts and provide financial services to foreign banks, banks in Barbados must establish CBRs with banks in the US. The reality is, as CBRs are removed, international clients in Barbados will not have access to foreign currency bank accounts and having a Barbados dollar account will be futile.

The best solution to this issue is licensing a Caribbean bank in the U.S. and having that bank provide Corresponding Banking Services to banks within the Caribbean. This will eliminate the need to depend on US banks to provide CBSs to local Caribbean financial entities.

Countries that are deemed susceptible to illicit activities such as money laundering and terrorist financing need to rebuild their image and restore the confidence of the foreign jurisdictions as a means of reversing the decision to withdraw CBRs. The most effective way to do this is through enhanced customer due diligence, increased compliance and the implementation of a robust AML and CFT regime. These actions will aid in mitigating the risks associated with engaging with the respondent financial entities and restore the confidence of foreign jurisdictions.

The EU blacklist is not due to be finalized until October 2020, however we need to lobby to get this extended until 2021, as countries are under immense pressure moving their countries, people and economies forward, in the most unsettling times in our lifetimes.

There is still an opportunity for Barbados to strengthen and implement a more robust AML/CFT regime, however, given the ongoing progress and legislative amendments that have been made, the FATF, CFATF and other global leaders can be reassured that Barbados will take heed and swiftly reverse the blacklisting movement. Barbados is known for its political and economic stability and despite the current global crisis, the country will readily restore its high international reputation and continue to operate compliantly irrespective of the circumstances.

By Rianna Holas

Private Client Advisor

Leave a Reply