International Fundraising & Private Investment Funds

Are you an owner-operator, of your own oilfield and production company? Do you manage less than 100 oil wells? Now that the “offshore” (shell company) industry is gone, the ability to raise capital from unregulated sources is becoming more difficult every day.

Many SMEs (small to medium enterprises) who export agricultural produce, or are oil and gas companies may need to raise US100M or less to start or develop their projects. Typically, owner-managers of oil & gas projects are raising somewhere between US5M – 50M. However, they cannot raise this at home because big banks and financial institutions only want large deals. Large oil & gas firms like Shell and Exxon and global commodity brokers are reducing their risk by financing working capital deals less and less. More and more the environment for the owner-manager is changing. You would think that needing to raise fewer funds was a good thing, but it actually makes fundraising much more challenging.

NOTE – A private investment fund is also known as an Alternative Investment Fund (AIF). The Irish regulations provide for licenses for qualifying investor alternative investment funds (QFAIF).

Do you have an export business?

From the perspective of US investors, an oil & gas exporter in Africa is international and non-US in origin. Typically, oil & gas exporters are doing some business in the US but the firm and its risks still originate from outside the US.

Are you setting up a business in the USA?

Are you setting up a business in the USA?

African owner-managers seeking to raise funds from US accredited investors with the purpose of growing or starting their business could consider starting up complementary businesses in the US. They could also consider becoming licensed asset managers of investment funds that invest capital in projects that are owned and operated by themselves. We will consider some specifics of both approaches below and how they may help with raising “international capital”.

Private investment Funds can be registered with the US SEC

Caribbean jurisdictions like the Bahamas, Cayman Islands, and Barbados provide options for regulatory platforms that can be used to do international fundraising, including from US-accredited investors. Investment funds can then be registered in the USA to enable the onboarding of accredited investors.

The value of having to set up this regulated investment fund to raise capital in the US may seem unnecessary to some or maybe not worth the cost and time. US fund managers and General partners of Limited partnerships, hedge funds, and private placements go to great lengths to take advantage of the opportunity not to be registered with the SEC under exemptions provided by federal and state rules. This reduces costs and compliance.

Possibly, this line of thinking may have been recommended to you.

These exemptions are not ideal for international owner-managers of non-US businesses who are Non-US persons trying to raise capital in the US from accredited investors. In your case, the SEC and regulated status is your friend. Utilizing platforms that are registered with the US Regulator will improve your ability to raise capital from US-accredited investors.

Why use a private investment fund to raise capital from international investors?

In our experience, SMEs from Nigeria, or perhaps Ghana often utilize Caribbean-regulated platforms to invest in the USA. We recommend SMEs that are family-owned and owner-managed use regulated asset managers and private investment funds to raise cross-border or international capital.

As outlined above, SMEs like this is international because the farm or the oilfield or tech company is based in an African country and re-exporting to many customers in the US, EU, or China.

These firms have many opportunities for growth. But, they are often viewed by accredited US investors as too risky because they are international and thus don’t fit the risk profile of many investors in the USA. Private Investment Funds can help reduce some of these risks and make it easier to raise the money you need to grow your business.

These firms have many opportunities for growth. But, they are often viewed by accredited US investors as too risky because they are international and thus don’t fit the risk profile of many investors in the USA. Private Investment Funds can help reduce some of these risks and make it easier to raise the money you need to grow your business.

Raising capital in the US is governed by the US Securities Act. This means the activity and communications of raising capital and promoting investments are regulated. You have to consult a securities lawyer to make sure the way you market and communicate your investment to US investors conforms with the laws and regulations of the USA. Investment Advisors and broker-dealers are subject to regulations when it comes to promotion and advertising in the US. Promotional activity in the US, which is communication with potential investors, must take place after US securities counsel has advised.

Registering with the US SEC

A regulated asset manager is a company that has a license to provide fund management or asset management services from a regulator in a jurisdiction like the Bahamas, Barbados, or Ireland.

The main benefit that the international SME obtains by using a regulated asset manager and private investment fund, is that registration with State authorities or the SEC is often possible. The compliance departments of the private banks where your US Investors hold their funds will look at a retail asset manager and private investment fund as “low risk’. This means your investor won’t be blocked from investing in your offering. Remember, a licensed broker-dealer should always be engaged.

It will then be possible for the US-accredited and sometimes non-accredited investors and institutions to invest in the private investment fund. As outlined above, family offices and accredited investors intending to invest via regulated platforms will not be blocked from investing by their compliance departments.

International Investments are often blocked by the investor’s compliance department after they have said yes to your proposal.

We have seen many SMEs spend much time and effort on raising capital in the US, only for the investment to fail due to blocking from the investor’s compliance department.

Raising cross-border capital, therefore, requires thoughtful structuring. It is not just about the tax structuring but the regulatory risk profile “low or high risk” that will be required to successfully get the funding.

The fiduciary duty of US investment advisors and US broker-dealers providing services to Private Investment Funds

The principals of international SMEs should enquire about the asset managers of their private investment funds to confirm whether a fiduciary duty is contained in the service agreements with investment advisors and broker-dealers.

Legal counsel from civil law African countries, who may not be used to the law of equity should nonetheless make sure they benefit from it and should ensure US counsel advises on this point.

International investors face substantial challenges due to being flagged as “high risk”, no matter how strong the economics of their proposition is. The presence of the fiduciary duty is an important mechanism to help make clear to investors that there is risk mitigation in the arrangements when undertaking to fundraise in the USA. US investors will also find this fact reassuring and if possible, it should be included in the fundraising promotional documents.

“The SEC stated that an adviser’s fiduciary duties encompass a duty of care as well as a duty of loyalty.

(b) Obligations with respect to the duty of care run to:

(i) Suitability (and a duty of inquiry to support a reasonable belief that advice is in the best interests of a given client);

(ii) An obligation to seek the best execution; and

(iii) A requirement to monitor performance over the course of a relationship.”

As international investors, the difficulty of being flagged as “high risk” by compliance departments in financial institutions presents substantial challenges, to raising investment from US accredited investors. The presence and knowledge of the fiduciary duty is an important mechanism to make the cross-border private investment fund more robust.

How will a private investment fund help you to raise capital from international investors?

Owner managers from Africa should use a private investment fund to raise more than just capital for their businesses. Private investment funds also offer a regulated platform that can help your business open new markets, grow your company, and create jobs.

In order to be successful when fundraising in the United States, it is important to partner with an organization that has a deep understanding of the local market and access to a large number of accredited investors. A private investment fund can be especially beneficial for owner-managers from Africa who are looking to access US capital.

In order to be successful when fundraising in the United States, it is important to partner with an organization that has a deep understanding of the local market and access to a large number of accredited investors. A private investment fund can be especially beneficial for owner-managers from Africa who are looking to access US capital.

Many US accredited investors will have their capital in custody in U.S.private banks whose compliance departments may flag some “international transactions” as being high risk. Therefore, an international business in the US financial system needs to use an “international solution” to raise capital from US LPs, GPs, and family offices.

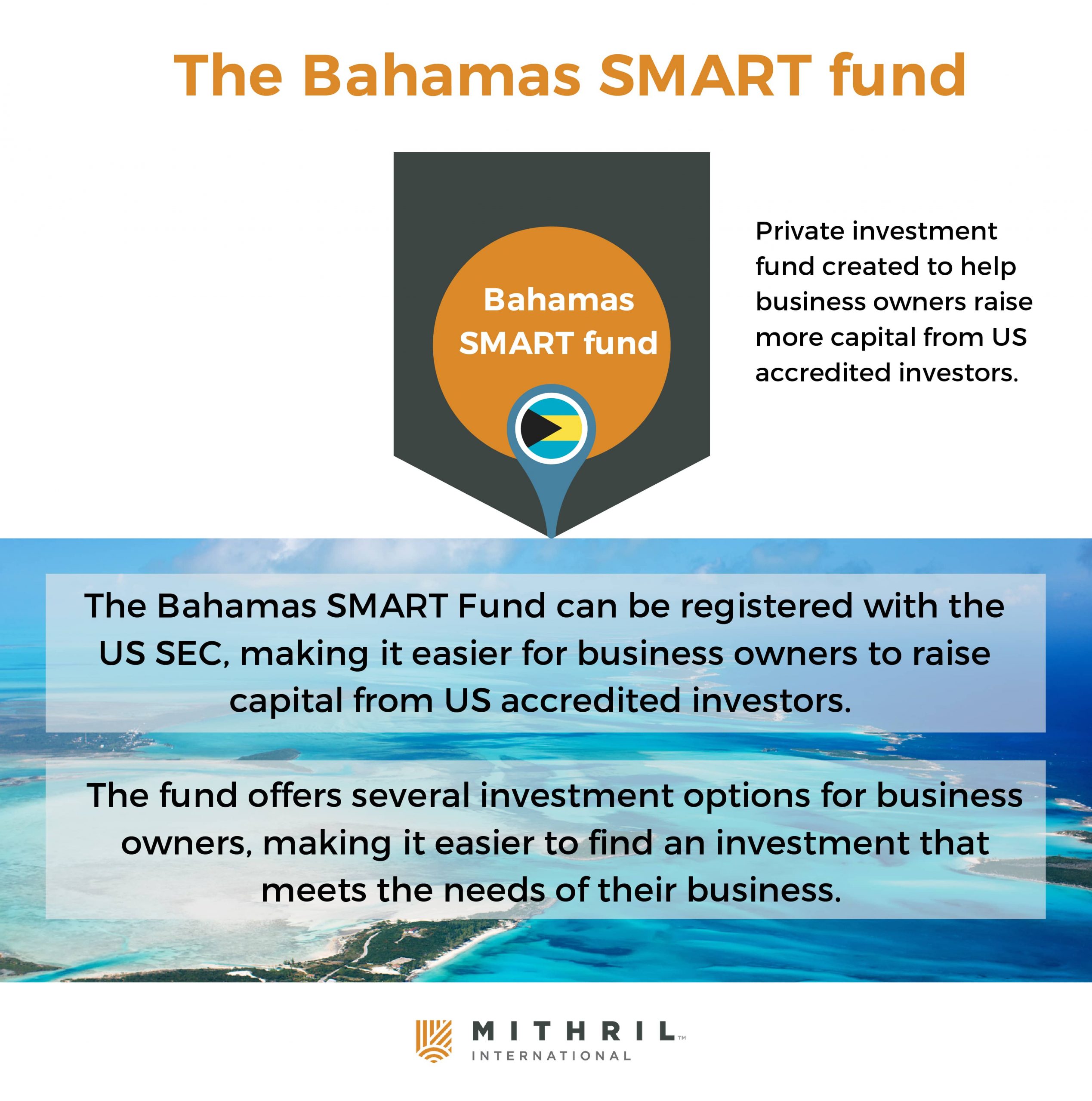

Bahamas SMART funds

Bahamas SMART funds are ideal for international owner-managers raising capital from a number of internationally accredited investors while keeping costs under control.

o The Bahamas jurisdiction is IOSCO A-rated.

o The Bahamas jurisdiction is IOSCO A-rated.

o Note that for Brazilian owners the Bahamas fund will be recognized by the rules of the Brazil CVM – this makes international transactions easier.

Fundraising from US accredited investors is made effective with the help of a private investment fund such as the Bahamas SMART fund.

Establishing a Complementary US business to assist with international fundraising.

You could also consider setting up a commodity broker company in the US. This could be regulated or unregulated as appropriate and would be used to assess the risk and identify the best commercial options for trading oil and gas.

Owner-operators need to consider new approaches if they want to raise capital from international investors. Using a U.S. business with commercial reality can enable international owner managers to build relationships with potential investors by enabling them to first take “domestic risk” before going international with you. Owners can raise capital to grow their US or Canadian domestic business.

By establishing a commodity broker operation in Canada or the USA that will have supply agreements with your operation, you can gain access to capital to grow your international business. A commodity broker’s job is to optimize the risk of acquiring a supply of commodities. A commodity broker or distribution company can effectively finance the inventory risk of the international business. The balance sheet, supply contracts, and financial and economic risk will now be located in the USA or Canada. Once the company has completed its compliance, the US and Canadian investors will be able to invest in this company, which is a domestic risk, not an international risk. This approach enables the owner-manager to begin developing relationships with potential investors.

A commercial business vs a Listed Holding company.

Many mining and oil & gas firms list holding companies in Canada or England. Listed platforms are certainly ideal for pension funds and large institutional investors. Then they try to raise capital from non-institutional accredited investors. Non-institutional accredited investors in the U.S. and elsewhere are highly subject to “international” compliance risk. A well-regulated platform such as a listed company in Canada has not done anything to limit the international risk of the business. The international risk is still present. Using listed companies is not always ideal for owner-managers who are the “key men” and owner-operators when it comes to delivering the project.

A commodity brokerage operation, managing investors’ risk, would go a long way to building trust with the US and international investors by using a platform with more domestic and thus compliance risk. A private investment fund or alternative investment fund arrangement can also be used to further “de-risk” your international investment opportunity.

Leave a Reply