The implications of NFTs for international owner-managers

Owner managers with international oil & gas or mining projects are already using Defi for cross-border or international payments. International banking has become difficult for owner-managers over the last two years, so in response, innovation has been adopted.

Using NFT Securities for raising international capital appears to be a very interesting prospect. I will make some observations of NFTs that are securities. The context of any notes I make on any US securities always includes consulting US Securities counsel.

NFTs are securities and utilities

Long term utility

Long term utility

The owner-manager can add utility value to the NFT later on after primary issuance. Oil & gas or mining projects can for example offer some clients, the option of access to something physical. In the case of gold or other valuable minerals, this has wealth management options. Access to physical gold with a clean source of funds is highly desirable for investors.

NFTs, Branding & ESG

International owner-managers, have the option of embracing the creative aspect of NFTs. This can be seen as an opportunity to provide investors with a layer of value. Oil & gas and mining owners can commission local art for NFT creation and branding promotion. This is a new community and sustainable engagement opportunity for oil & gas and mining owners. This is not charity; it is a potential for a win-win business arrangement. SME owner-managers have to turn ESG compliance into potential and not just a layer of cost. Using NFTs in conjunction with ESG compliance is an idea that can work for oil & gas and mining companies.

There is tremendous potential for NFT creative art, with African art, and Latin American art. The NFT presents a branding opposite the potential and the ability to enable the owner to earn fees from NFTs being traded as well as raise capital – while addressing ESG compliance – these synergies are a boost to the oil and gas business model.

NFTs – international transactions and Permissioned Defi networks

International owner managers and operators should always use and work on permission blockchains and networks. International transactions across permission networks are more conservative for interfacing with the regulated financial system.

The regulated environment will continue to evolve, especially in the US, but owner-managers need to keep a clean source of funds and need to avoid complex international AML entanglements.

The digital identity systems and AML compliance layer will continue to evolve and have less friction over the next two or three years. So there is no need to risk litigation, especially Criminal international litigation. If you know you are going to be raising capital in the US, make sure you use a robust platform for any and all international transactions.

International fundraising & Digital Assets – NFTs

The international project is still best structured via a Private Investment Fund, registered using a regulated asset manager. Remember, the compliance departments of your investors, custodians, and fund administrators, all have different definitions of international compliance risk. Compliance risk is subjective. So to approach US accredited investors unlike domestic U.S. PE Funds, you need to use a regulated platform.

NFTs and raising capital for international projects

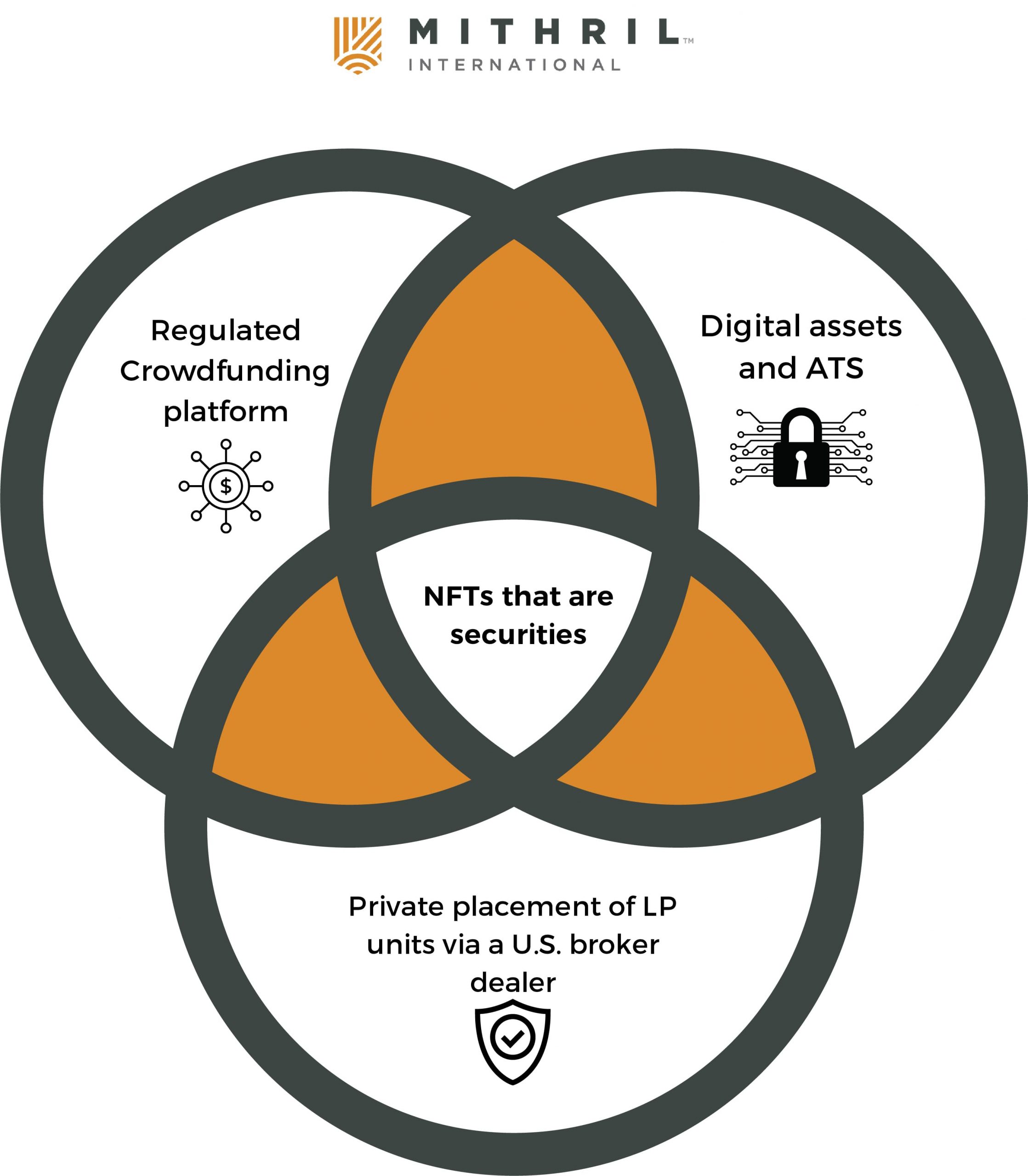

NFTs that are securities can be issued and sold by regulated platforms;

- A regulated Crowdfunding platform that also has a Broker-dealer license. This is assuming a Company was established in the US or Canada.

- Digital assets and ATS. Some Crowdfunding platforms have the ability to issue digital assets and also facilitate the secondary trading of those digital assets. These tech stacks often include the option for these digital assets to be taken into custody as well. This means the asset manager can engage a single platform for a range of services. This is all new – keep in mind there is a lot of work to be done vetting and putting arrangements in place. But the capabilities are real. The practicalities are new.

- Private placement of LP units via a U.S. broker-dealer and an LP established for US investors. The GP should include a private bank or a regulated asset manager as owners and directors. The owner-manager can consider offering both traditional LP units and NFTs.

Investor protection – Separation of ownership and Control

When an international owner-manager or operator is setting up a Private Investment Fund – whether it is a trust, a company, or a limited partnership, investor protection is an issue that will be considered – especially by savvy accredited investors.

When an international owner-manager or operator is setting up a Private Investment Fund – whether it is a trust, a company, or a limited partnership, investor protection is an issue that will be considered – especially by savvy accredited investors.

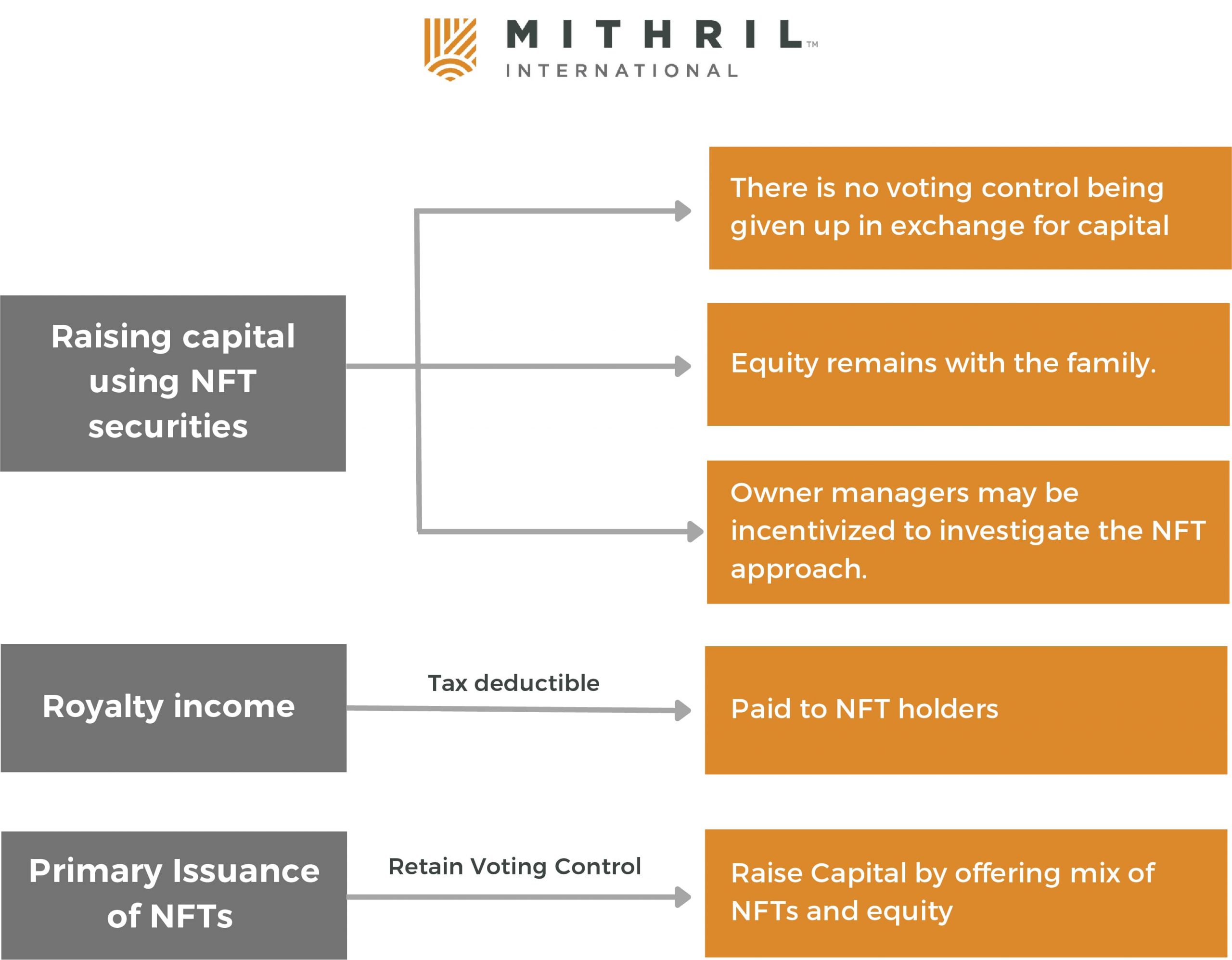

- When raising capital using NFT Securities, there is no voting control being given up in exchange for capital. Equity remains with the family. Owner managers may be incentivized to investigate the NFT approach.

- Royalty income paid to NFT holders may be classified or characterized as royalty income and not dividend income. Royalties are tax deductible.

- Primary issuance of NFTs. NFTs are a method of raising capital, without giving up voting control. International owners can offer a mix of NFTs and equity. NFTs could also be used to incentivize strategic investors without giving up “control” or introducing legal uncertainty into the Private Investment Fund by issuing more rights to certain investors. NFTs offer the potential for more alignment between shareholders.

NFTs and ESG compliance

In the future, the oil & gas or mining firm could establish a local project with local artists to create NFTs as part of an ESG community project and issue them to existing investors. The NFT would have an ongoing and long-term need for creative input so the ESG project would be great established on a long-term basis.

NFTs and Governance

Accredited investors investing in Limited Partnership units typically don’t have control of the project or the ability to interfere with management. So NFTs provide an avenue that could bring more value to investors and to some extent mitigate any perceived lack of investor protection.

Building relationships with US-Accredited investors

NFTs offer international owner managers a range of dynamics and behaviors to balance the needs of investors for protection. A well-executed NFT project could offer investors the ability to trade NFTs and begin earning while the project is in the initial phase. The investor’s ability to trade on the ATS means they don’t have to be subject to all of the same restrictions and limitations that LP Units present to investors. There are many ways international owners can in the future, attach utility to NFTs for various investors.

Accredited investors vs International investors

Some US RegCF Crowdfunding platforms offer the ability to place securities with accredited and retail investors and the US and international investors. This is a powerful business model considering;

- Primary issuance of digital LP Units and NFTs

- Secondary trading of NFTs

- International retail and accredited investors

- The US accredited and retail investors.

International owner-managers should give serious and considered thought to issue NFTs and other securities to retail and accredited investors. In the US, the fiduciary duty is real and enduring law. In order to access a RegCF crowdfunding platform, a US or Canadian corporation is to be used to hold shares in the fund.

The NFT securities in the US would have to be issued via the US or Canadian corporation or via the RegCF platform to US accredited and retail investors. As we have stated elsewhere, legal counsel in multiple jurisdictions would have to work closely together to ensure compliance. International investors will have US rights to litigation as the U.S. Securities and platform would have been used. No owner-manager should deploy a fundraising strategy that could lead to international commercial litigation based in the USA.

International risk and investors are not accredited

Smaller oil & gas projects, that have a sound track record and are expanding or are being repurposed, or where there are additional new projects on top of existing ones. These projects present risk but those that have existing underlying operational substance and track record may present a better quantum of risk for smaller or retail investors.

NFTs, ESG and access to capital

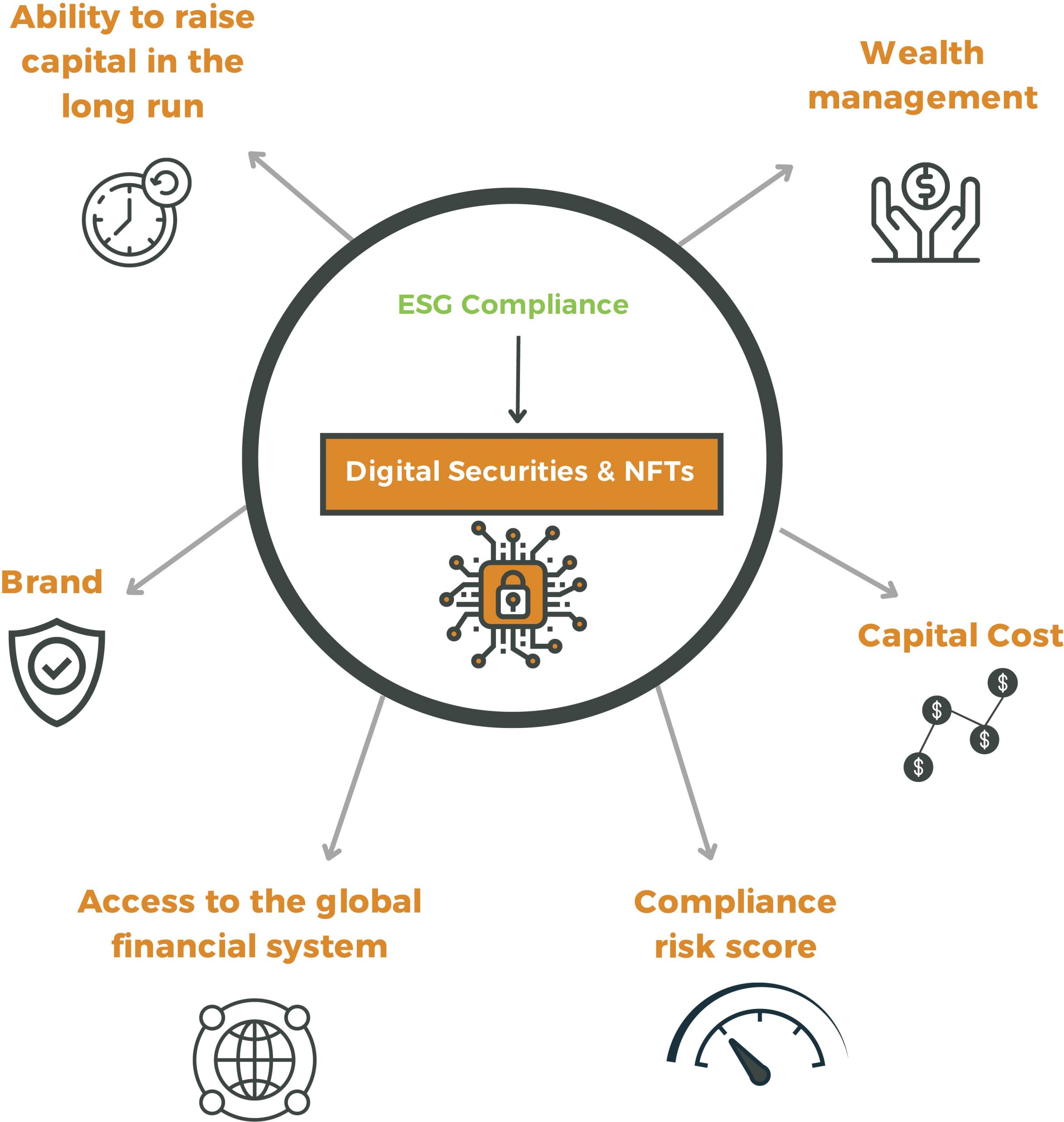

Owners should consider their long-term reputation and compliance ( read brand ) and long-term access to funding. NFT projects and ESG analytics means there will be long-term data and connections to your brand, who you are, and what you have done in a long-term way. The historical implications of these mechanisms are new to owner-managers.

The implications for owner-managers of algorithms, blockchain, digital assets, securities, and branding, are long-term. While these new approaches are going to be exciting and rewarding, international owners should remember that digital assets and transactions history will be recorded immutably on the blockchain. In the near future “social proof” will be included by algorithms in your “compliance risk”.

So digital securities and NFTs due to ESG compliance will impact;

So digital securities and NFTs due to ESG compliance will impact;

- Brand

- Reputation – “compliance risk score”

- Ability to raise capital in the long run

- Cost of capital

- access to the global financial system

- wealth management

The link between your company’s Brand and fundraising performance will be determined by the extent to which your ESG projects are run and executed. If reports and allegations are made against your ESG projects. If investors complain, data analytics companies can scrape the web, and social proof will be available. All of these things can have financial implications for the international owner-manager and his firm.

International owners who have high-risk exploration projects may want to restrict NFTs and fundraising to the private placement and accredited investors only. If there is a good balance of risk, open the project to accredited and unaccredited investors. Or raise capital from accredited first. Derisk your project to some extent then raise further capital in the second stage from all international investors via NFTs and Units.

International risk mitigation + Captive Insurance

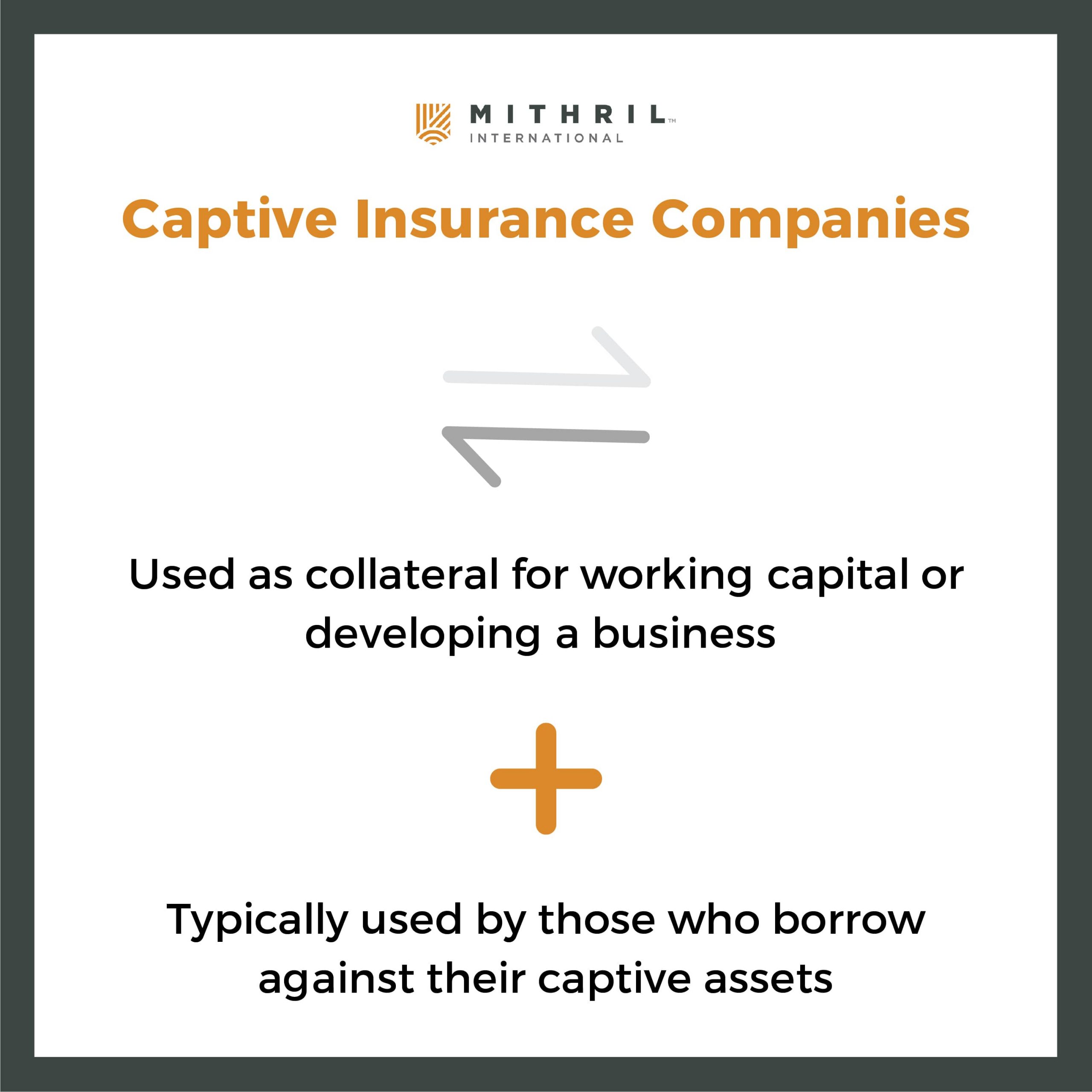

Captive Insurance is a robust mechanism to mitigate the risk of international projects. Especially for US compliance Departments that do not have any way to really assess risk in international jurisdictions. US banks have very little to no footprint outside the US and Europe.

Large private banks that manage the portfolios of US and other accredited investors, and will be sensitive to their clients investing in what they view as projects with “high compliance risk” because they are international. Private banks will also be sensitive to their client’s “ AML Score” which will be impacted by investments in international owner-managed projects.

Large private banks that manage the portfolios of US and other accredited investors, and will be sensitive to their clients investing in what they view as projects with “high compliance risk” because they are international. Private banks will also be sensitive to their client’s “ AML Score” which will be impacted by investments in international owner-managed projects.

The international owner-manager is at all times competing with US domestic projects for capital. The US accredited investors mainly invest in domestic projects and if international, that is done with large institutions.

A Captive reinsurance company built into the international project structure will go a long way to mitigating international risk for US-accredited investors. It will also provide a pathway to building engagement with US-accredited investors and their private banks and advisors. A captive insurance company is another way of incentivizing strategic investors without creating an imbalance in the main Private Investment Fund.

Practical matters of NFTs as digital assets, Defi, and securities

There is a lot of practical work involved in ensuring your GP is fully informed and working well with a regulated digital Platform that can do primary issues, secondary trading, and custody. Legal counsel in your jurisdiction and US must collaborate on these projects.

Active or passive income

We consider at a high level some of the international tax implications of rising in NFTS;

When NFTs are issued for capital. Is that real capital? How will accounting standards treat these funds raised? It is most likely to be capital but obtain clarity and ensure the investment prospectus is updated.

Royalty Income can be earned when NFTs are traded. When earning royalty income from NFTs being traded, will the owner’s jurisdiction of issuance treat this as passive or active business income?

In summary:

NFTs present the opportunity for owners of oil & gas and mining companies to use NFT projects to embark on ESG compliance and bring legitimate value to the communities they operate in.

Many US-regulated institutions, private banks, and custodians will all soon be mandating ESG compliance. International owner-managers need to find real ways of executing good NFT projects with long-term utility that are also tied to well-executed ESG projects.

Leave a Reply